Our review of Bokio

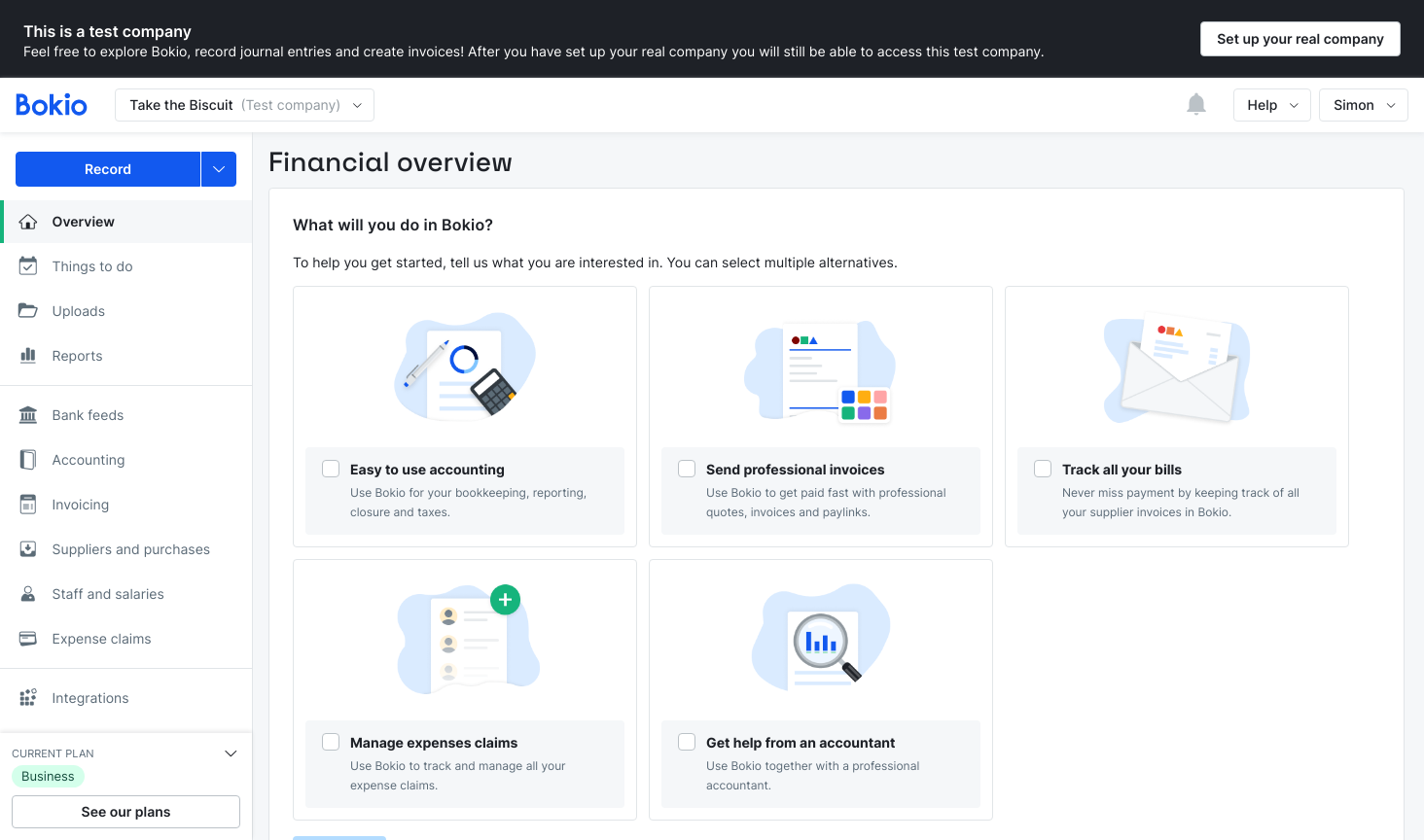

Bokio is good looking software, which does its best to follow FreeAgent’s lead in committing to jargon-free bookkeeping. It’s easy to navigate, and the menus are well designed and stop the screen getting too cluttered.

Whilst it was inevitable that users on the free version would be frustrated when Bokio announced plans to start charging for access, the new payment plans do leave Bokio in a precarious position.

Starting at either the equivalent of £19.95 per month if you pay annually, or £24.95 per month if paying quarterly, the paid plans do offer some solid features to users. Unfortunately, the new fees leave them far behind similarly priced competitors, and even much cheaper alternatives. For instance, the software is still missing some of the key bookkeeping features you’d expect from paid software these days, such as project tools, mileage trackers, or inventory management.

The new fees are likely to mean that Bokio can fund further product development but for what they’re offering at the current price point, small businesses are likely to find their needs better met elsewhere.

Review breakdown

-

Ease of use

-

Speed

-

Features

-

Support

-

Price

-

User Experience

Summary

Overall Score

User Review

( votes)Software Features

Ease of Use

Bokio is fairly easy to use in most cases, though a little more thought to the user experience would help improve this further. For instance, there are dropdown menus which make it easier to select the supplier or customer details you want to use for an invoice. This is great, until you have an enormous list to scroll through, so a search box or auto-suggestion list would be a much better solution.

On a more positive note, you can also add new customers and suppliers from the invoice screen without losing any existing progress you’ve made creating an invoice. It's useful if you forgot to do that first!

The menu layout is good, and finding tools and features is pretty self-explanatory, with any software or accounting jargon kept to a minimum.

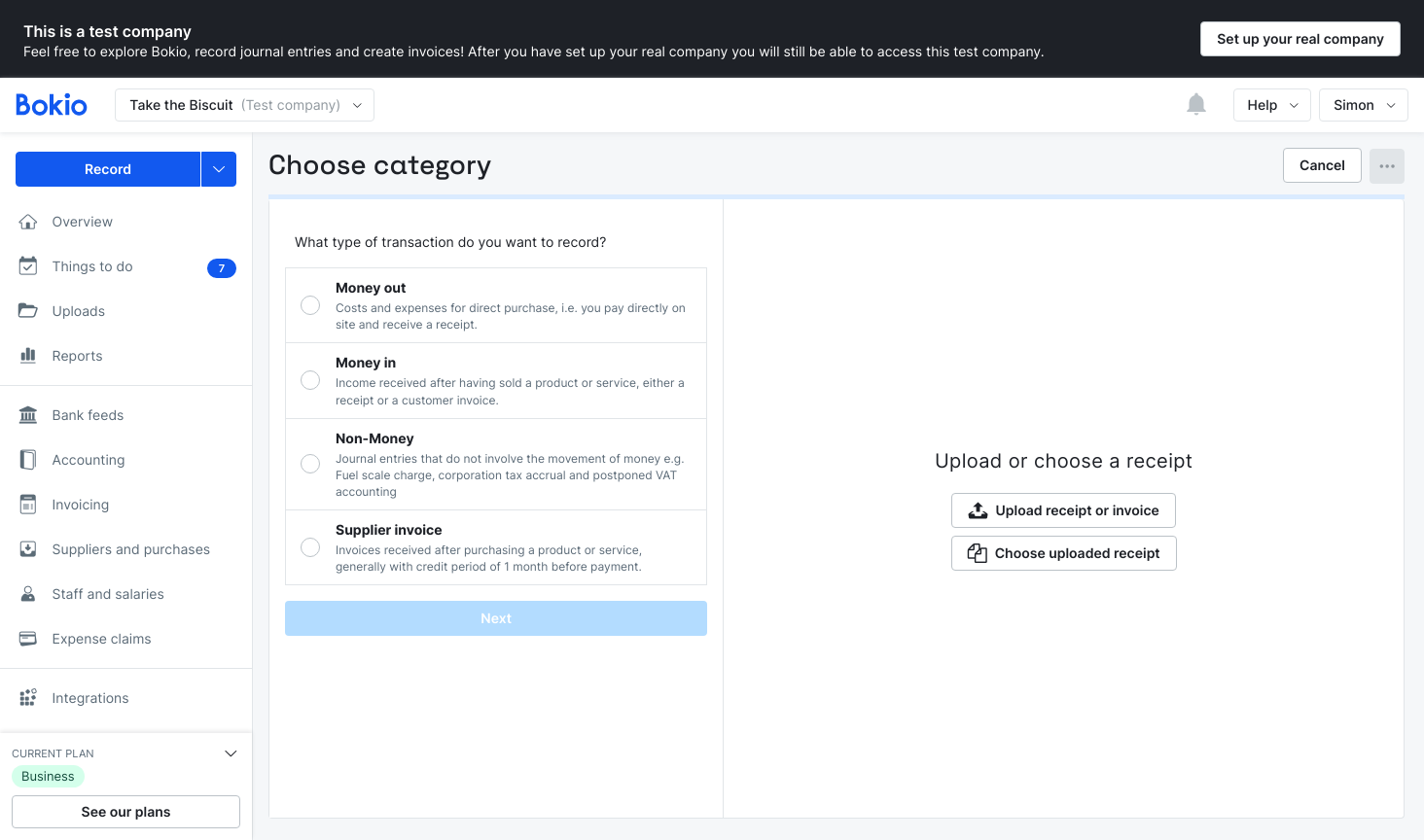

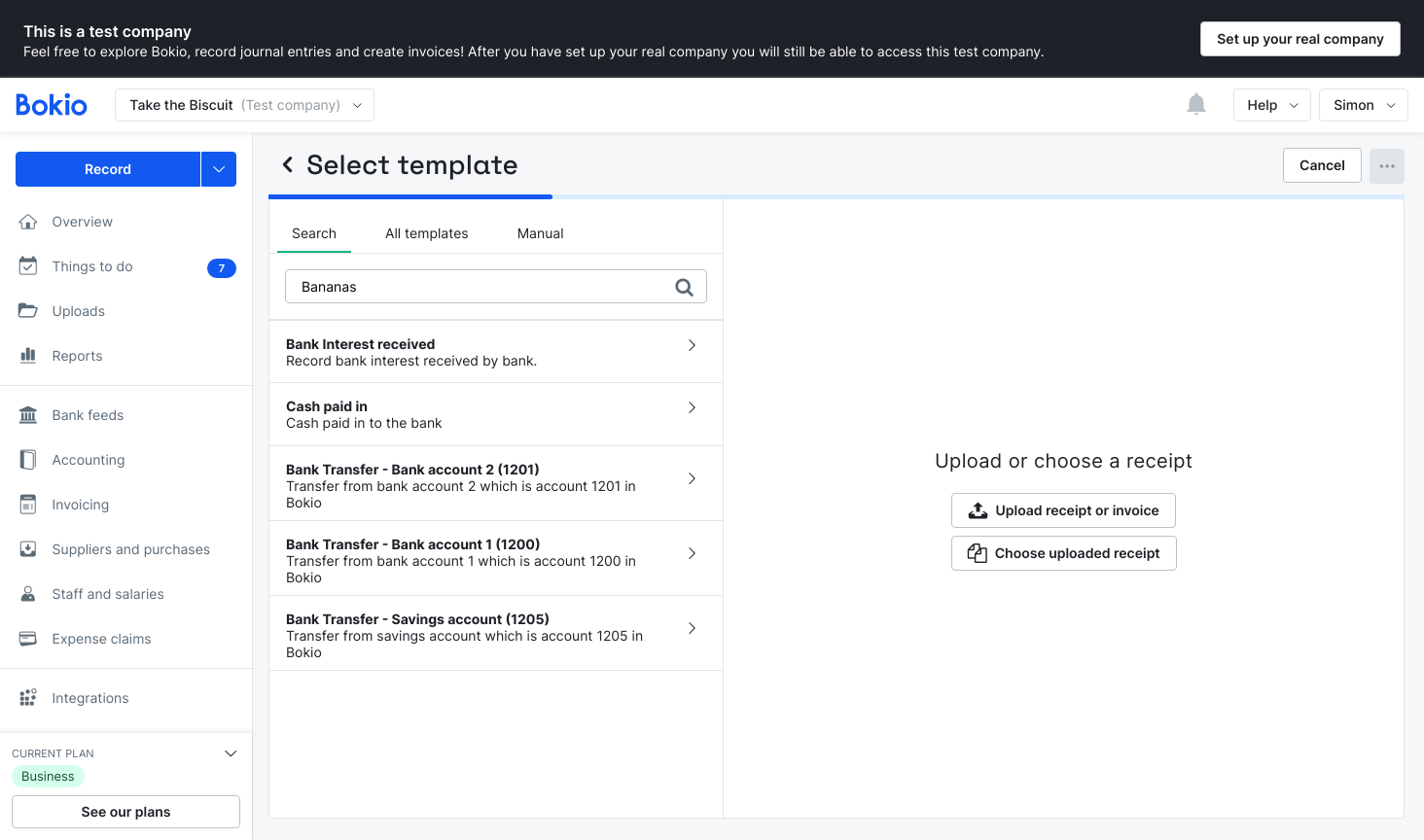

There are some processes which could be confusing, especially for less experienced users. For instance, when entering our first transaction (for money in). Despite asking ‘what did you sell’, Bokio uses the data you enter to search a list of transaction templates.

Bokio say this is so that users don’t need to worry about taking care of debits and credits (so we assume this means the software manages the double-entry bookkeeping for you). In practice, the process is quite disconnected.

You can either use one of the suggested templates (which don’t really bear much resemblance to any item you might have sold), select a different template, or enter the information manually. Even users with basic bookkeeping knowledge are highly likely to make serious errors here. It’s also worth noting that the smart templates aren’t available on the free package.

Speed

Bokio loads quite quickly, and transitioning between screens and processes doesn’t cause any noticeable lag in the software. The simple layout and clear headings mean that it’s quick and easy to use, too.

There are also some good automations, such as the usual Bank Feeds and bulk editing tools, which further speed things up. Do be aware that even them some time-saving features that you might expect from other providers (such as stock control or a mileage tracker) simply aren’t available with Bokio.

Features

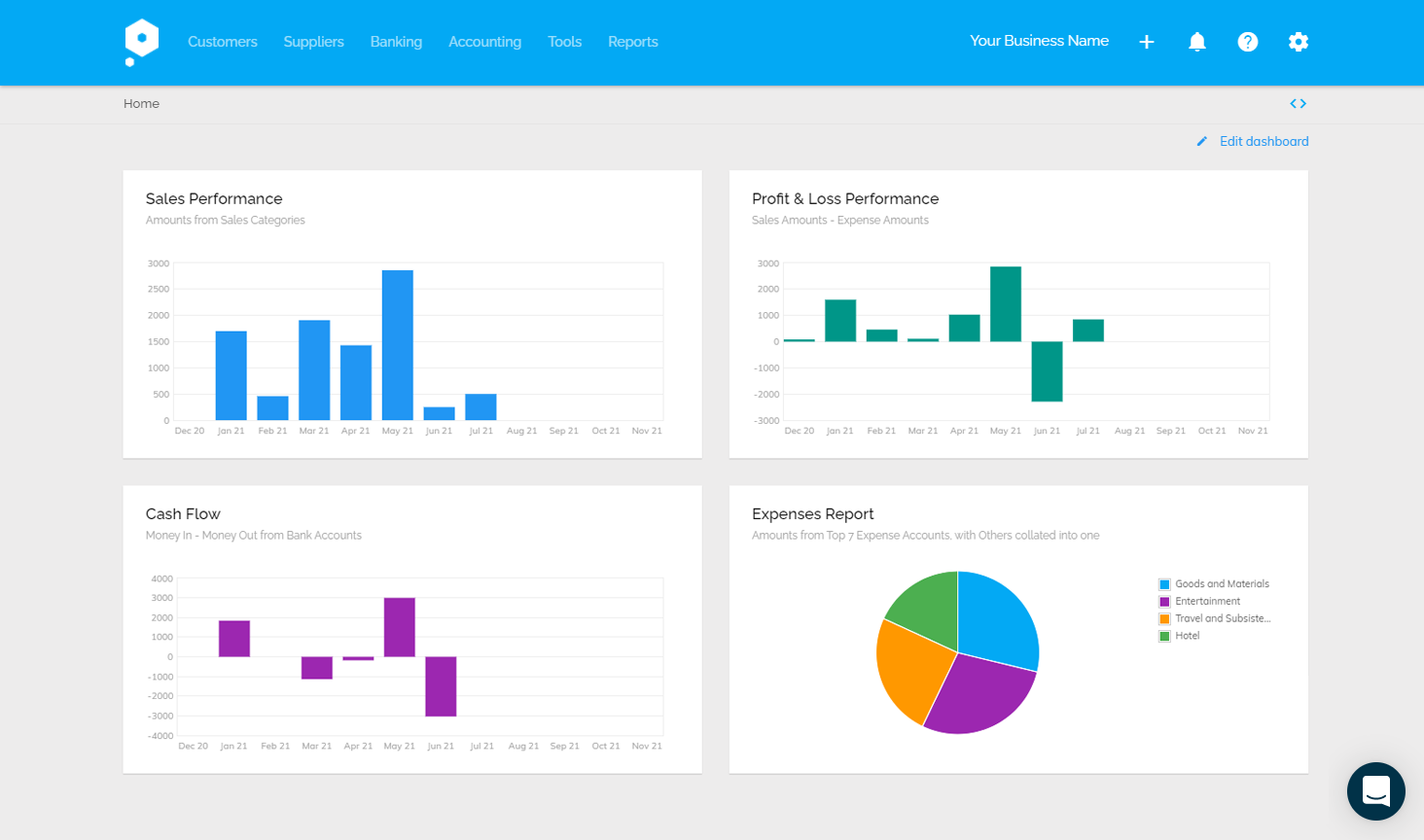

Bokio does have the more common bookkeeping features that we’d expect to see digital bookkeeping software offering these days, such as bank feeds, bank rules, payment integrations, and reports.

The bank feeds feature in Bokio is powered by Plaid, so there are lots of banking institutions to choose from.

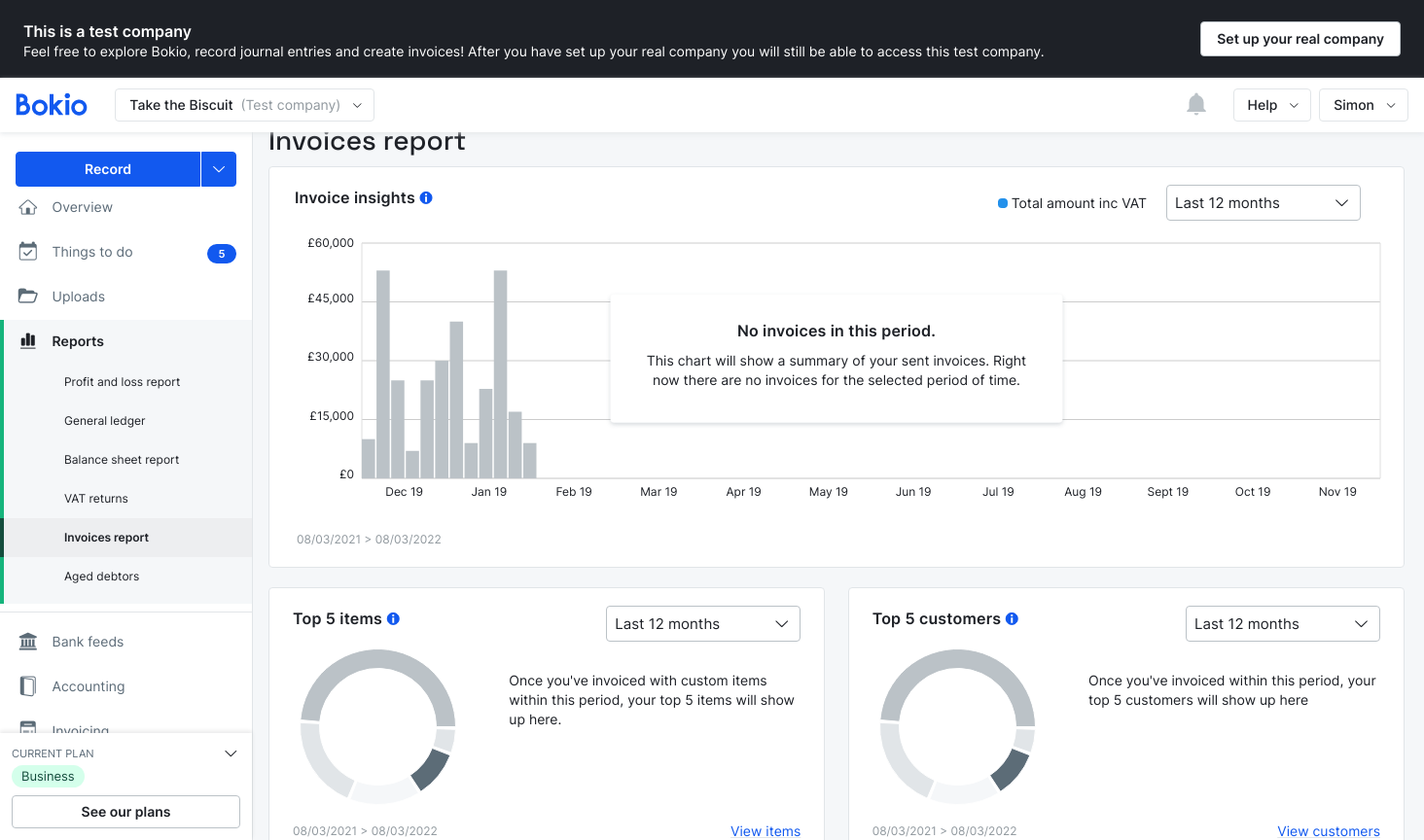

The reporting functions are mostly bare-bones basic (and don’t look that great either), though you can export the data as a PDF or to Excel. The invoicing report is a bit more interesting, and includes a top 5 items and top 5 customers display so you can see what’s doing well at a glance.

You can add employees to Bokio to make expense management a bit easier and there is a director’s payroll feature too.

The big issue is that Bokio promised to be free forever, only to phase in payment options, before abruptly removing the free option altogether. Sadly, these changes mean that Bokio now comes up against much more feature-rich competitors at the same price point. For those who relied on Bokio's free version as an invoicing tool, it will be particularly frustrating.

Hopefully the new fees will fund more serious feature development, because Bokio currently lacks any sort of projects tool or inventory management feature available elsewhere.

Support

Bokio’s guides are generally good, and they do offer product support though they're a bit cagey as to how you might actually be able to get in touch with them.

Price

Despite promising that Bokio would always be free to use, the free version has now been totally removed, with Bokio giving current users one month's notice. Announcing the changes, Bokio suggested this would help them develop new features. They have carried out lots of development work since introducing the original payment tiers, but they still don’t measure up very well compared to more feature-rich providers at the same price point.

What level of bookkeeping knowledge will I need?

It varies across the software. Using the software is mainly self-explanatory, but there are some areas where novice users are likely to make mistakes, such as entering transactions.

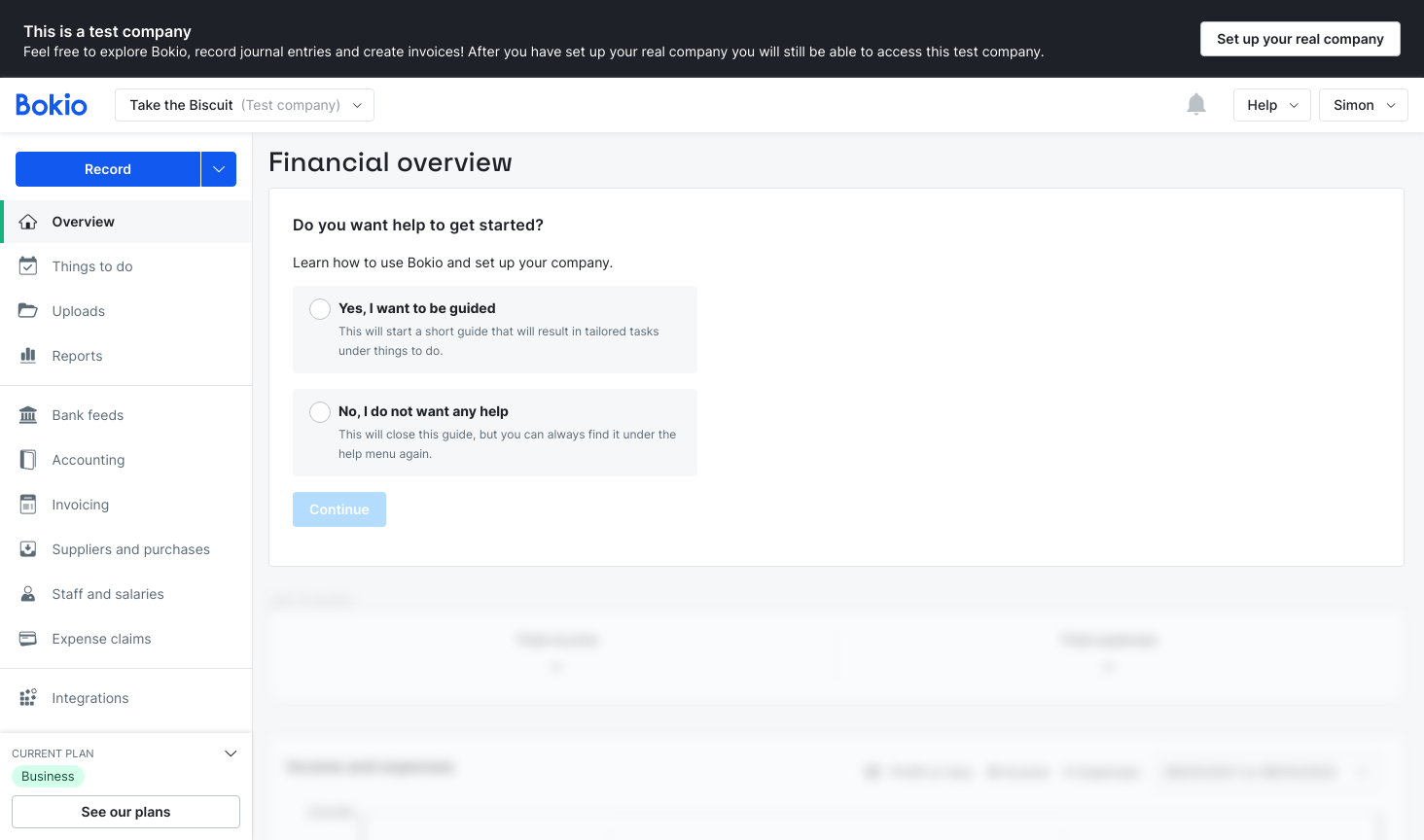

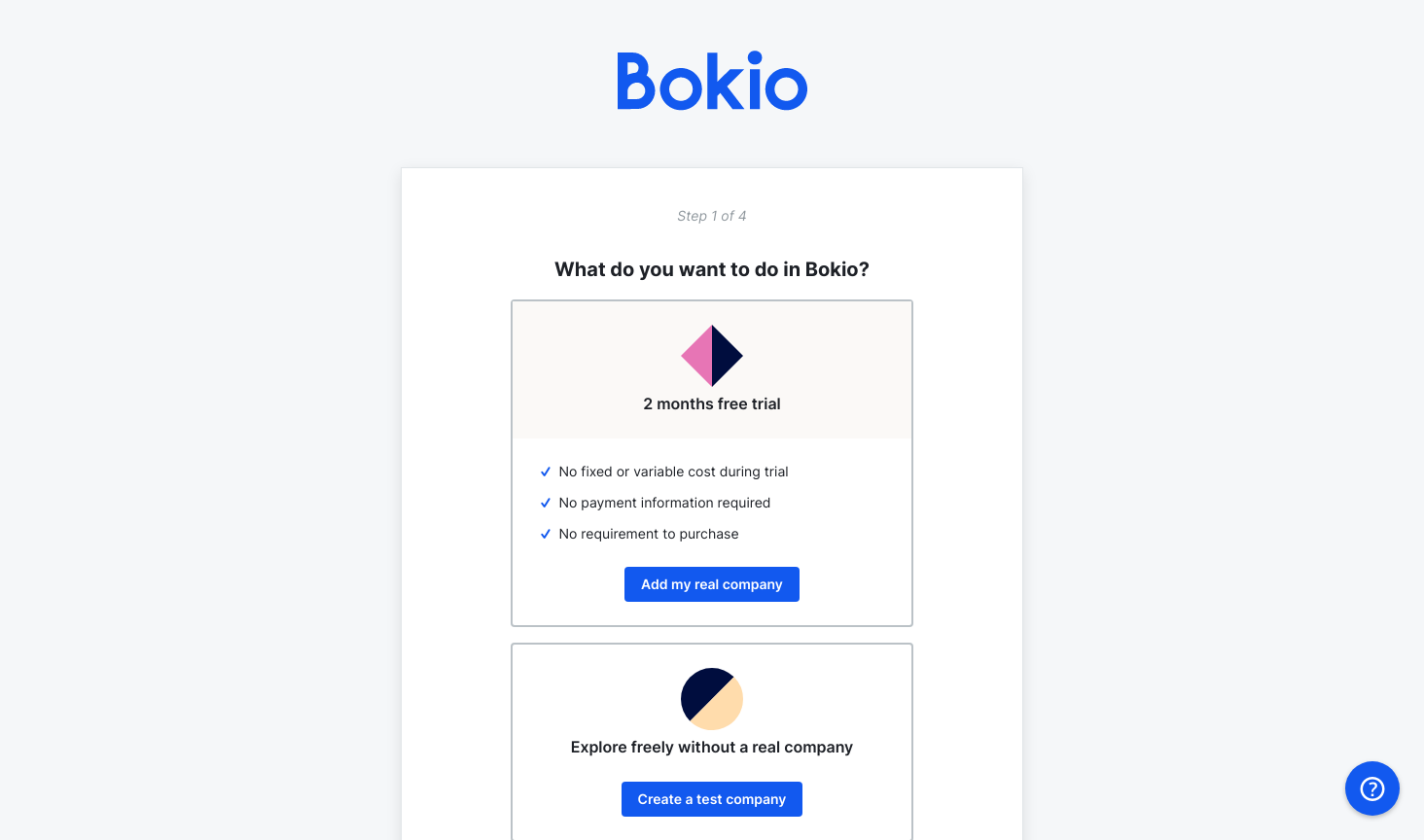

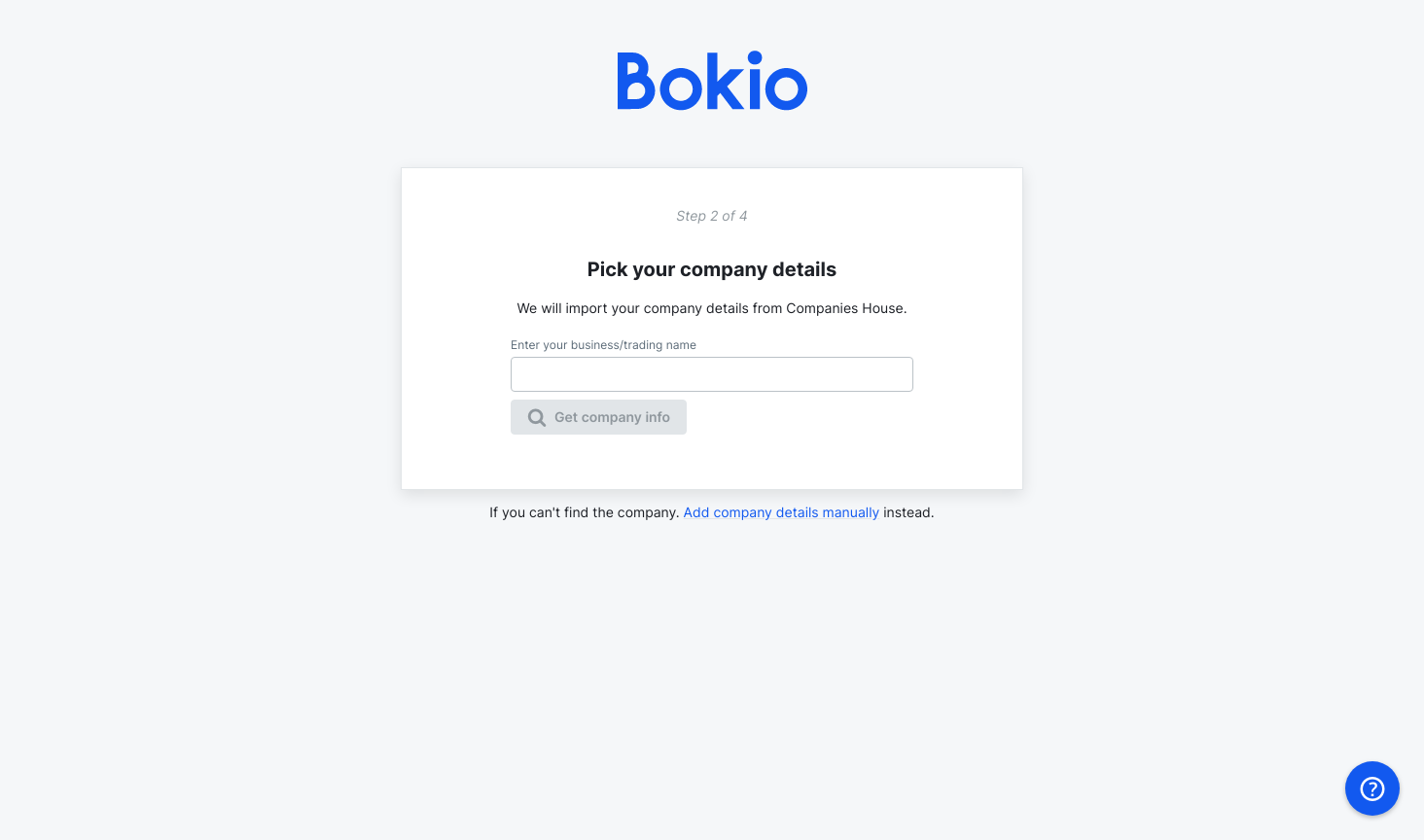

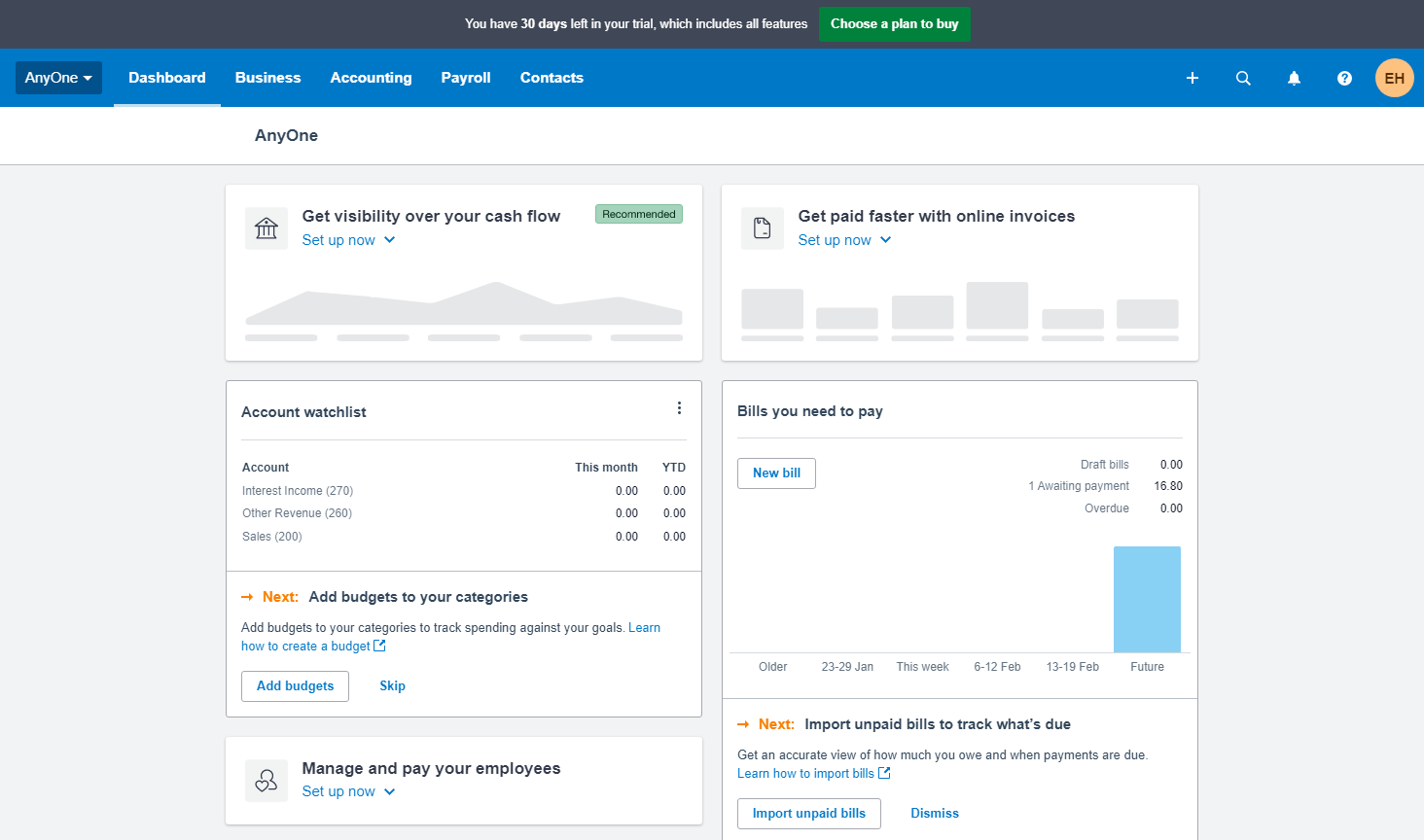

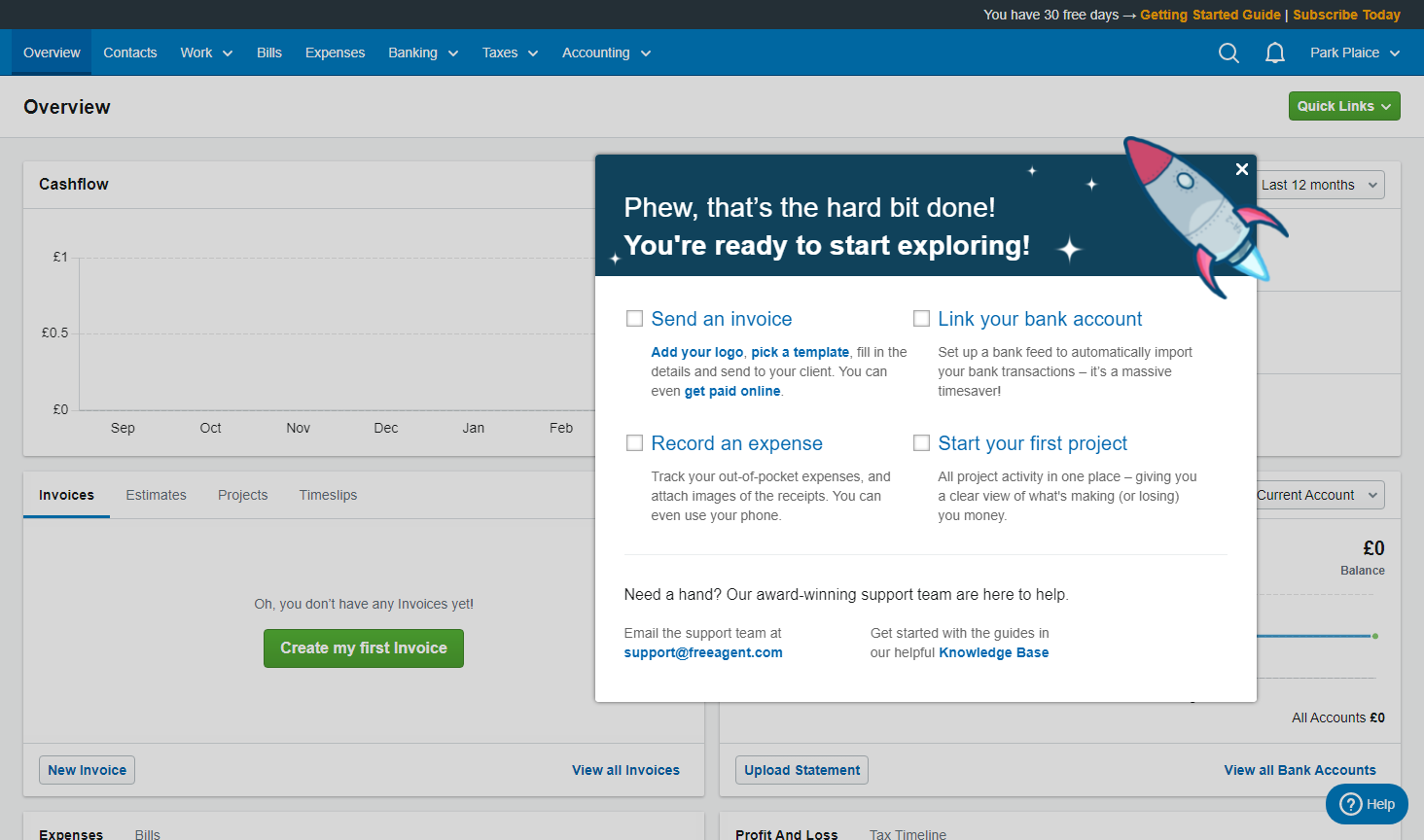

Software Screenshots

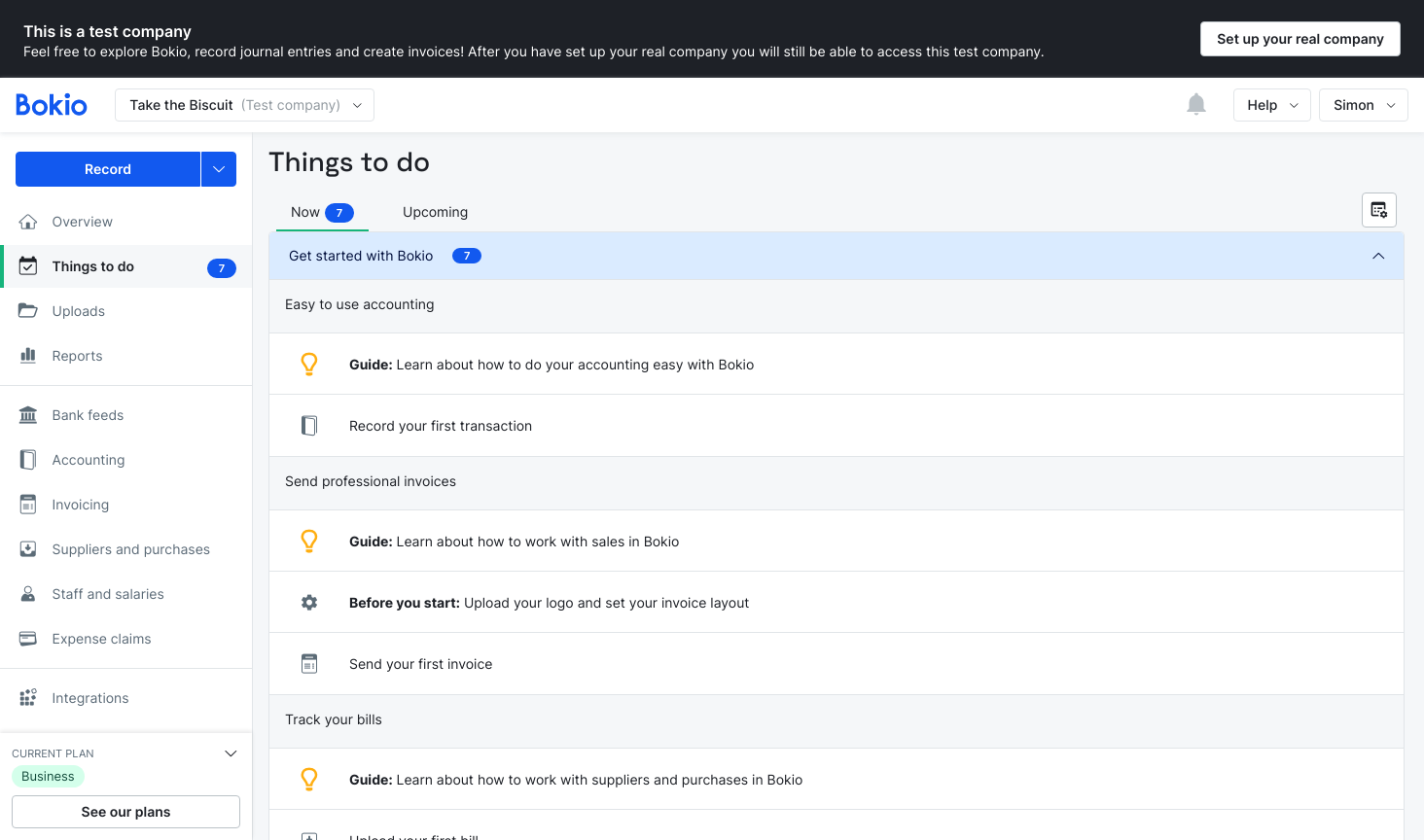

The software looks good, and the introductory guides and ‘things to do’ section are a nice idea.

The software just doesn’t offer the features that we would expect to see available at this sort of price. Judging by the comments on their TrustPilot page, lots of existing Bokio users are furious that the free version has been removed, and with so little notice.

If I could give less than one star I would. DO NOT USE THIS SERVICE. I rarely write negative reviews but they really deserve this one. Thier business practices are horrible. They started by having a free service that was awesome. I would constantly recommend Bokio to anyone who would ask. Then they moved the most commonly used features to a paid plan… Ok I understand.. They need to get in some money. Then they raise the prices twice within a year and also completely remove the lowest priced plan, forcing you into yet another price hike. Now Bokio is… Read more »

Kindly note that this company now refuse to allow you to delete your data unless you subscribe to their platform, for a minimum of a quarter (currently £74.85). Data is effectively ‘trapped’ in their system unless you sign-up, which is a scam, or ransomware, however you choose to spin it. There is no way on this earth I’d wish to have my crucial data housed with a company that runs its business and customer service so badly. There are many better options out there, being run by people who genuinely care. Avoid at all costs.

I really like this software. I am a bookkeeper and use Xero, Quickbooks and Wave. I chose Bokio free version for a company that was just starting out. I have since upgraded to the balance version and I’m very impressed. I find it very user friendly. Well done Bokio