Our review of Xero

Xero offer a thorough range of accounting tools, with plenty of support videos to help you use the software - in this respect it's easy to see why they're one of the big names in the industry. Probably the biggest barrier is the cost.

The pricing tiers restrict access by the number of transactions and users you can have, so users might find that they grow into the next tier quite quickly. This is worth mentioning because Xero does become rather expensive for growing businesses, particularly if you need to add anything extra, such as project tracking or expenses.

It's also worth noting that users have flagged issues with Xero's multi-factor authentication recently, and a lack of access to support is also mentioned frequently across several other review sites.

Review breakdown

-

Ease of use

-

Speed

-

Features

-

Support

-

Price

-

User Experience

Summary

Overall Score

User Review

( votes)Software Features

Ease of Use

Getting started with Xero involves the usual process of bashing in an email address and away you go. For security they do ask you to confirm your email which is always welcome from software dealing with the financial end of life.

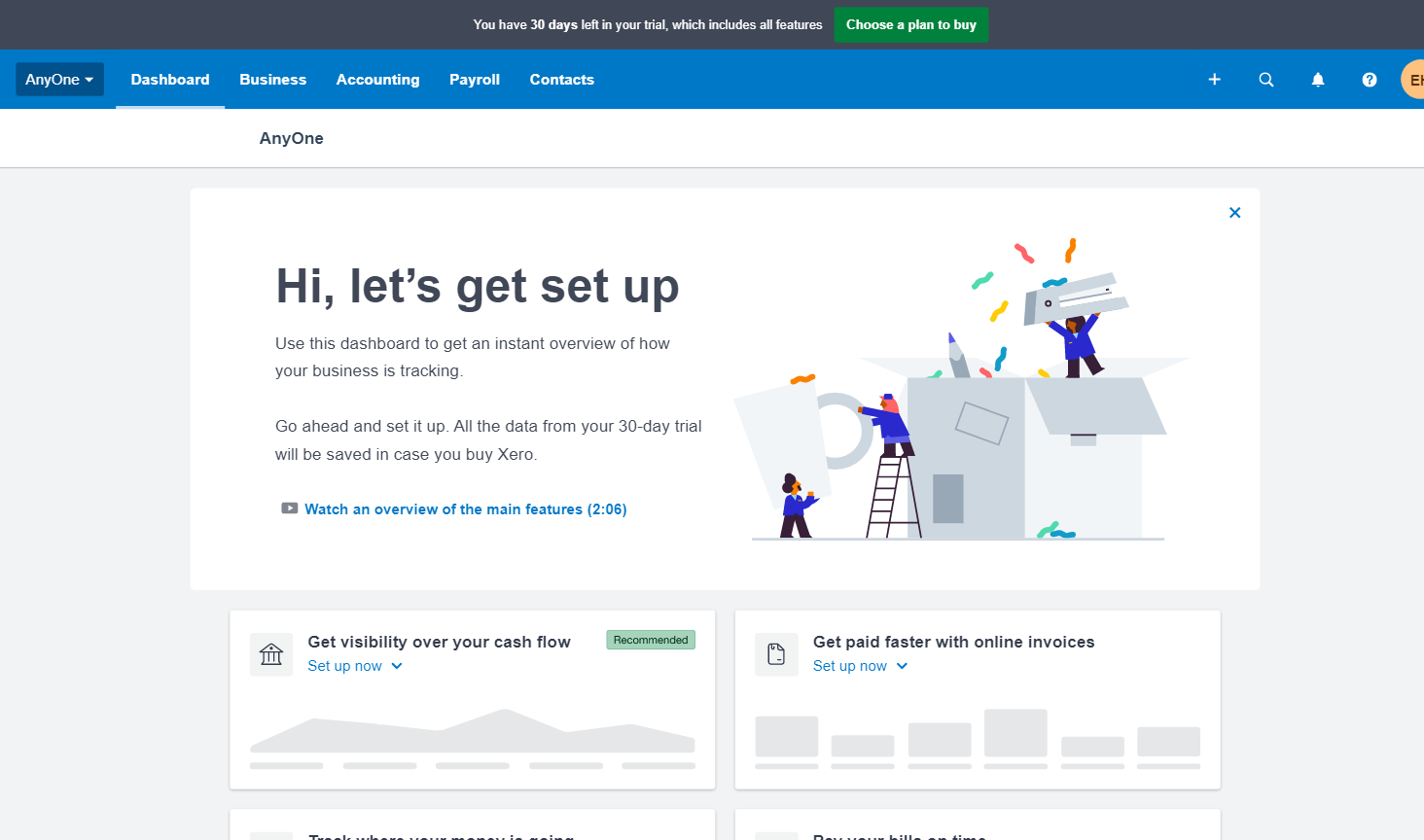

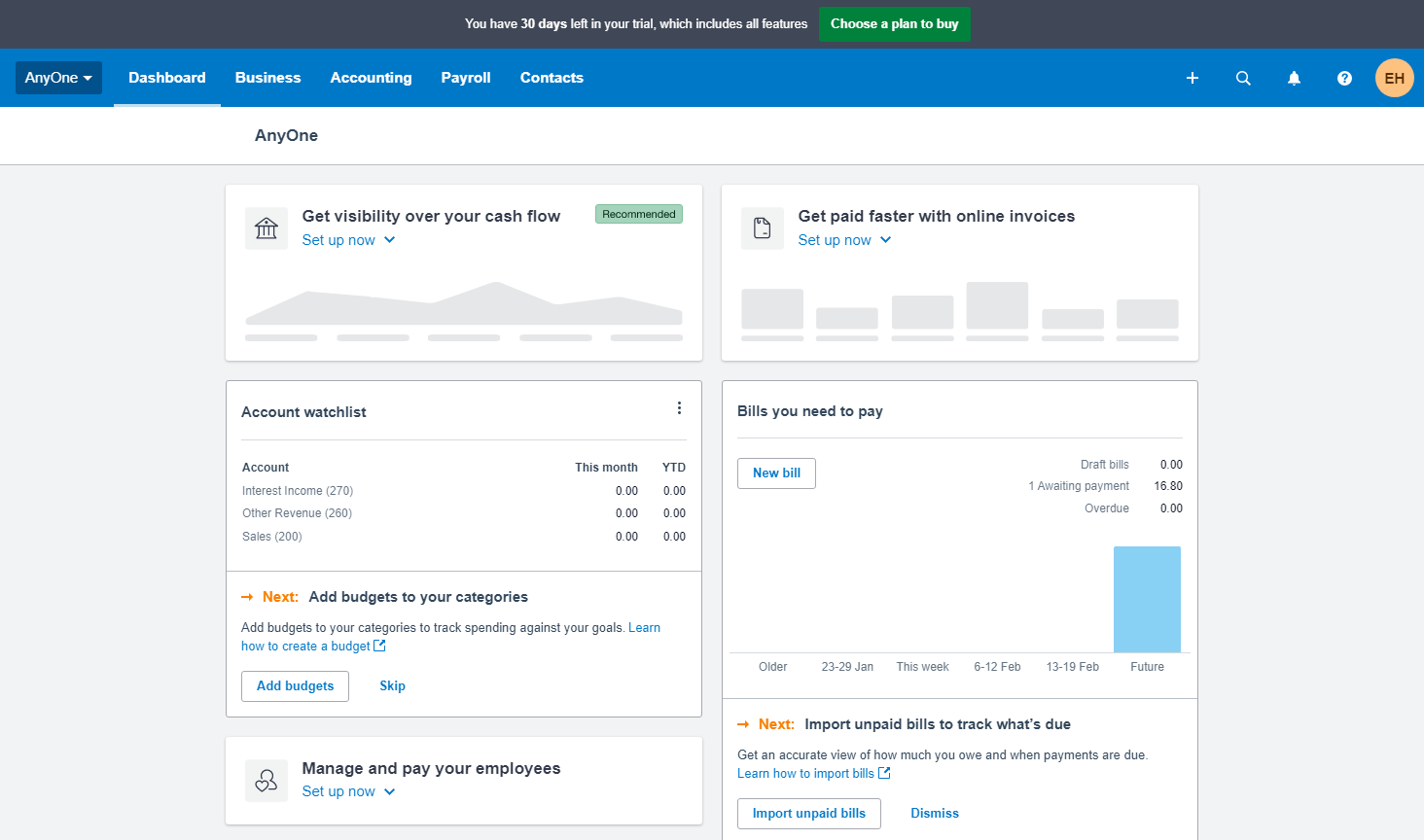

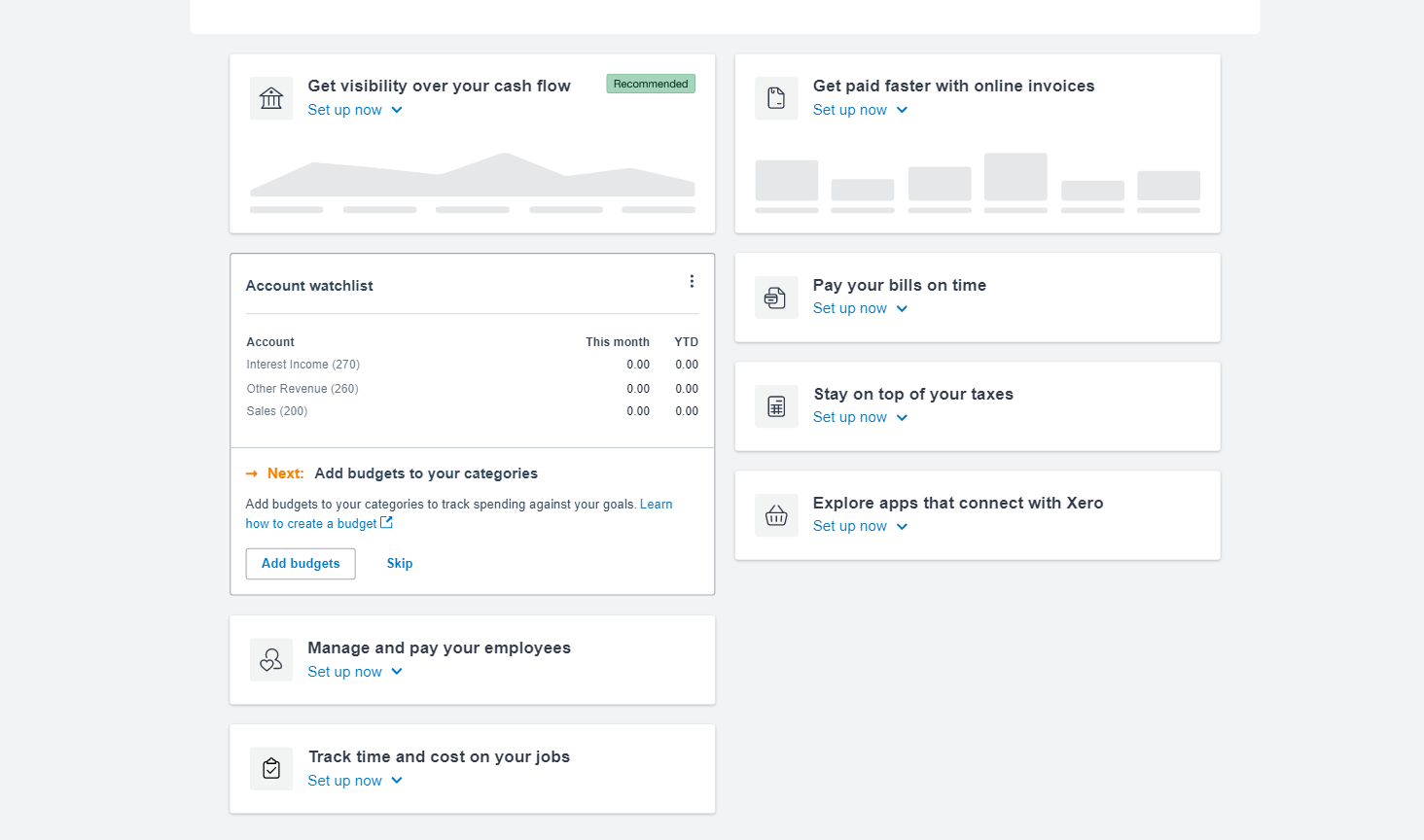

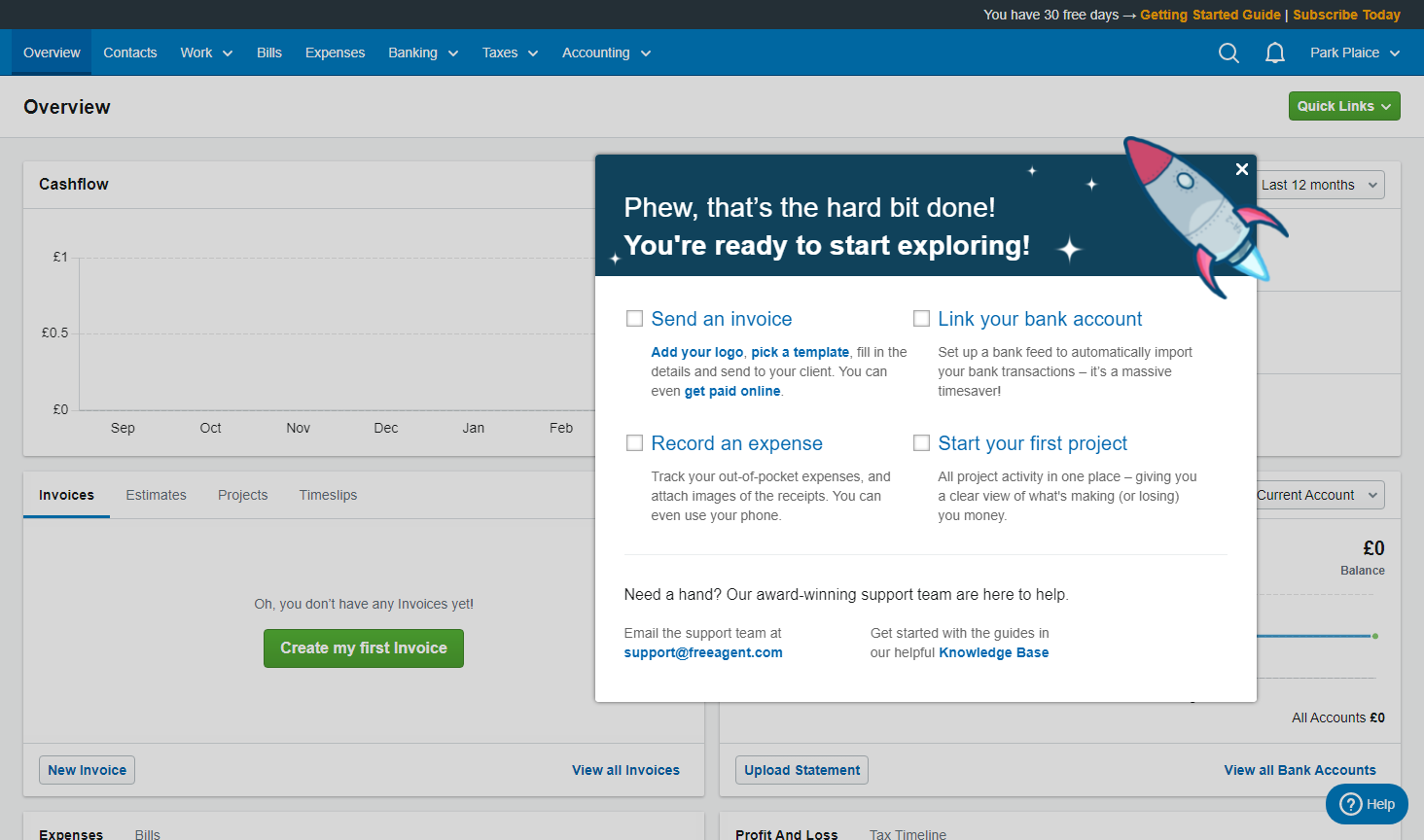

The initial welcome dashboard is split into sections signposting where you can set up each feature, like invoicing and cash flow tools, and there are lots of videos to watch.

Whilst it took us a while to realise the significance of the demo options, we really like this idea. Use it to take features out for a test drive without actually doing anything to affect the bookkeeping figures. Just don’t waste time (like we did) thinking we were setting up our actual account, whilst actually in demo mode!

The menu navigation is clunky, and the headings don’t really make any sense, so finding your way does involve a bit of wandering about.

Some steps and processes aren’t immediately obvious, such as adding bank accounts that don’t use an automated bank feed. It took us a few goes to realise that you had to ‘skip’ the automation step, but there is a way to manually import transactions if you persevere! We could also only access the bank rules feature after setting up our first bank account, which meant we were looking for it at first.

For instance, the placement and appearance of the ‘Add’ button changes depending on which screen you’re using.

A grey button with blue text under the page title, to add a new bank account…

Or a green button with white text up in the top right of the screen, if you want to add new stock items.

There’s also a risk that the software is a bit too flexible in what it will let you do, at times. We’re glad to see that Xero now lock some of the more crucial accounts (you used to be able to delete the VAT account!), but there’s still a lot of scope for getting rid of stuff you definitely don't want to delete.

In general, the software is easy to use but you will have to find the features you need, which could be an issue for novice users. You can edit your dashboard to customise the layout though, which is appreciated.

Speed

Fast enough when toggling between features, but it can be glitchy loading some screens. The Account Transactions report, for instance, was intermittently hanging during testing by us.

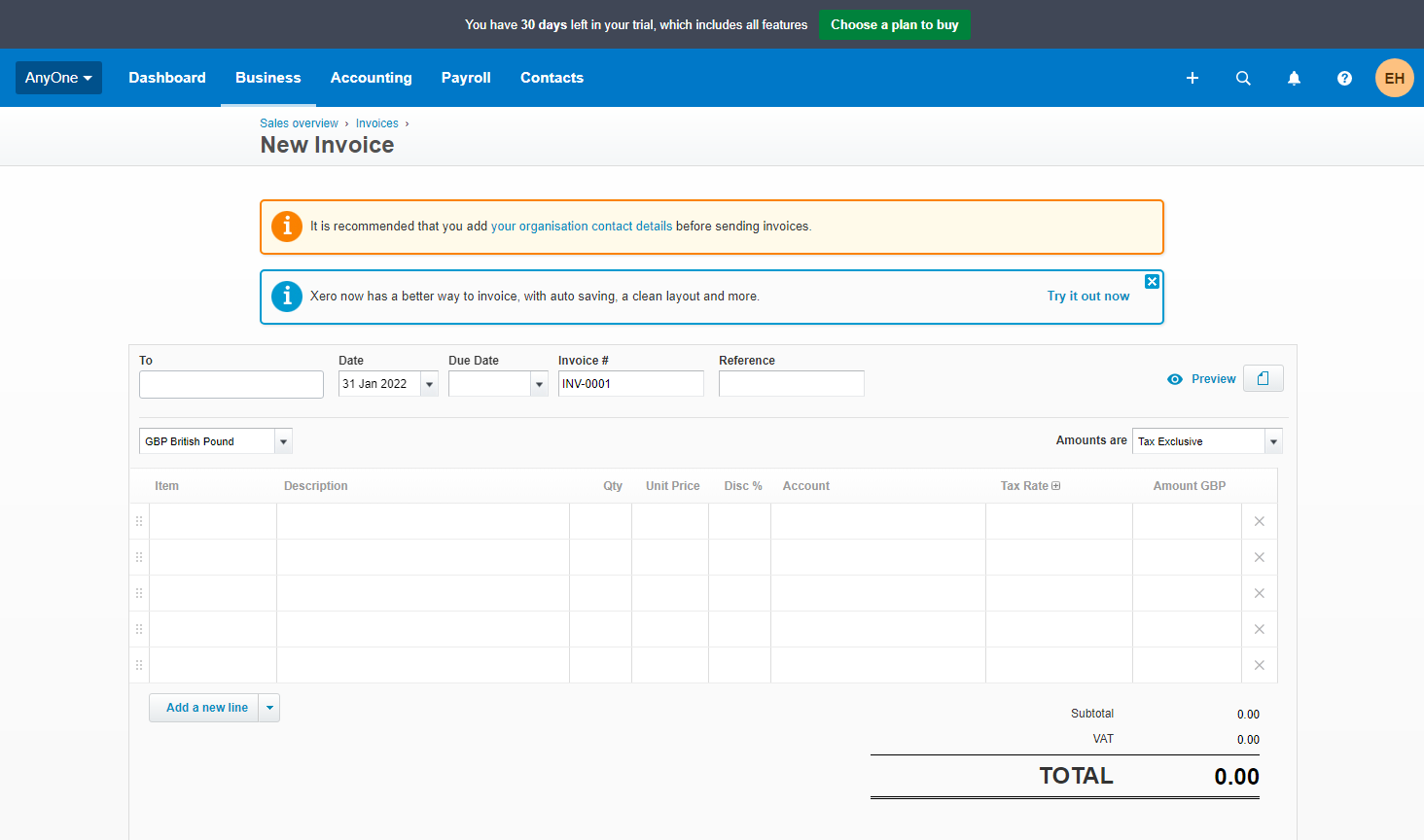

Entering invoices is a little slow but there is an option to enter bulk bank transactions which works pretty well. The navigation layout slows things down too, though with use you’ll probably get used to it.

Features

Xero are one of the industry heavyweights when it comes to bookkeeping features, so they’re solid in that respect.

Features include bank feeds, multi-currency, very detailed invoice design, stock control, receipt uploads, lots of third-party add-ons for e-commerce etc., project tracking and reporting tools.

Lots of those features are an optional add-on, for an additional fee on top of your package price.

Payroll is one of those optional add-ons, though it’s reasonably priced against dedicated payroll software. Wages (and the accompanying taxes, deductions, and contributions) can be confusing at the best of times, and any software is going to struggle to simplify it.

If we have to find something to gripe about, the whole bank reconciliation process is a bit of a pain for something which should basically be redundant if you’re already importing transactions directly from your bank with bank feeds already. That said, if you spend a bit of time setting up bank rules then you’ll get a head start on the repetitive stuff.

Support

Xero’s guides are terrific, covering various aspects of starting and running a business. Like their software, actually finding where they’ve hidden the good stuff is a bit more of a challenge! The same can be said of their customer support. Even after a good rummage around the software and website we couldn’t find a way to contact anyone for help.

We took a look at Xero’s Trustpilot reviews to see if we’re alone in this… apparently not.

Price

Xero’s 'Ignite' package is a decent price at £16 per month, though this limits you to 20 quotes or invoices per month, and 5 bills. The restrictions mean it's only really suitable for very small businesses, so it quickly works out as being expensive on a cost-per-use basis. There’s a big price jump up to Grow (£33 per month), and then up to Comprehensive (£47 per month).

We mentioned this already in the features section, but quite a few of their features are optional add-ons, which you’ll need to pay extra for, on top of whichever package you go for. For instance, the mileage and expense management tool is an extra £2.50 per month, per user. Similarly, the projects feature is available to those on the Ultimate package (£59 per month) for ten users - additional users cost £5.00 per month, per user.

What level of bookkeeping knowledge will I need?

It’s fairly easy to use once you find everything and get used to it. Users should know how to spot bookkeeping errors, so we think some experience would be required.

Software Screenshots

We liked the automatic VAT treatment of certain expenditure. This could help inexperienced users reduce errors, and saves a bit of time when entering the VAT code. We also liked how each nominal account was explained within the chart of accounts.

The user interface is nothing like the much more modern looking website, so brace yourself for dawn-of-the-internet styling. Finding your way round can be hard work, and if you need lots of features then the price will start to run quite high.

Video

Xero has no current plans to allow businesses to use their accounts and tax filing tool (its for partners only). If you have been using HMRC/Companies House to file accounts and CT returns you need to look elsewhere for an all in one affordable solution.