Our review of Crunch Accounting

If you need bare bones invoicing software with a few bookkeeping tools, then Crunch might be a good starting point for you. Feature-wise, Crunch simply doesn’t have the same range of tools which are available from other providers, so some small business owners are likely to outgrow it fairly quickly.

Whilst the pages do load quickly, the software does lack some of the most basic features that users might expect from bookkeeping these days. This lack of functionality also means that any time saved on with fast page load times is more than taken up by time-consuming data entry, or finding workarounds to tasks which other software providers have dedicated features for.

The lack of software support is the other huge drawback. If you have questions, you’ll either need to find answers in the community forum, or start paying for accounting services so you can talk to a real-life person for help.

Review breakdown

-

Ease of use

-

Speed

-

Features

-

Support

-

Price

-

User Experience

Summary

Overall Score

User Review

( votes)Software Features

Ease of Use

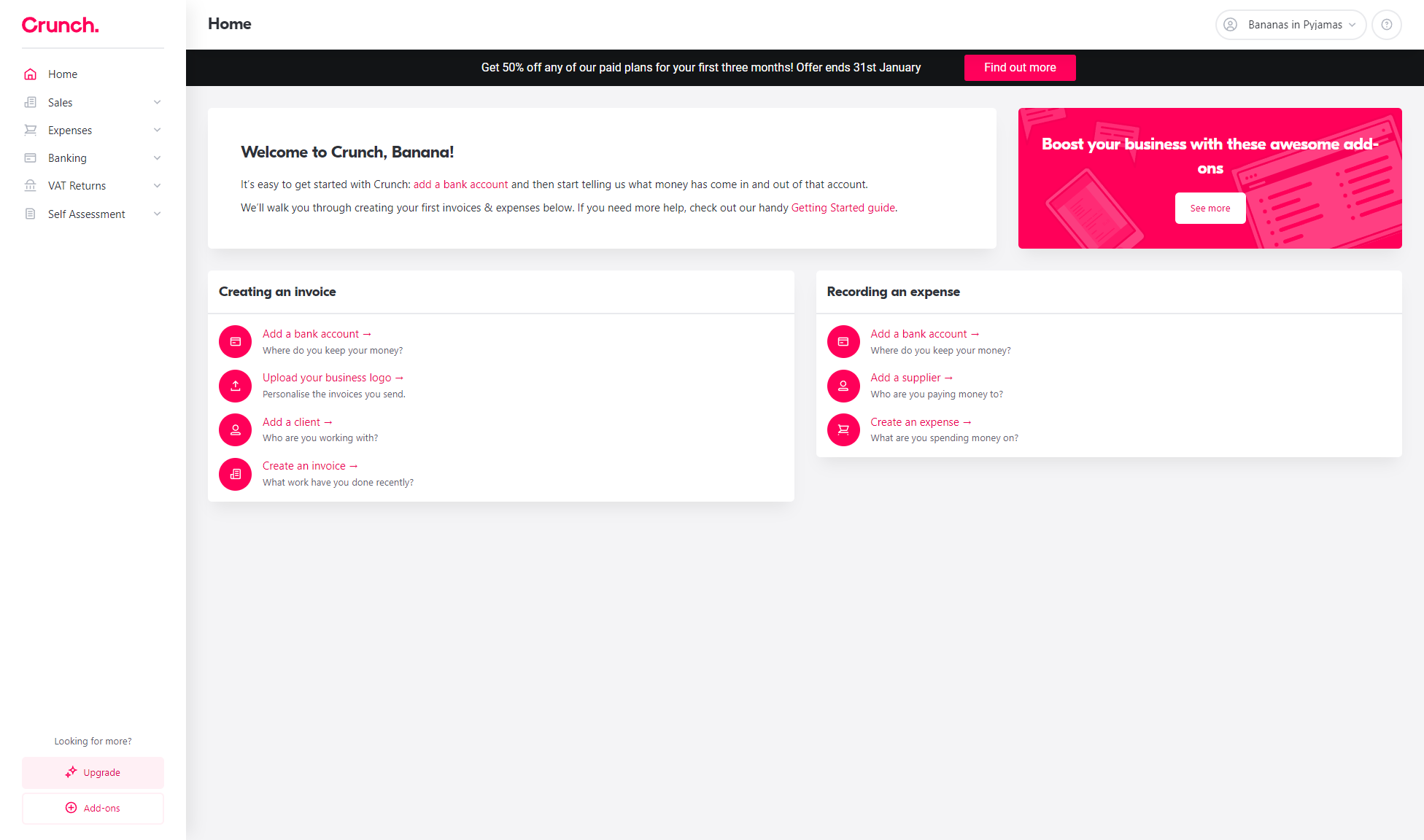

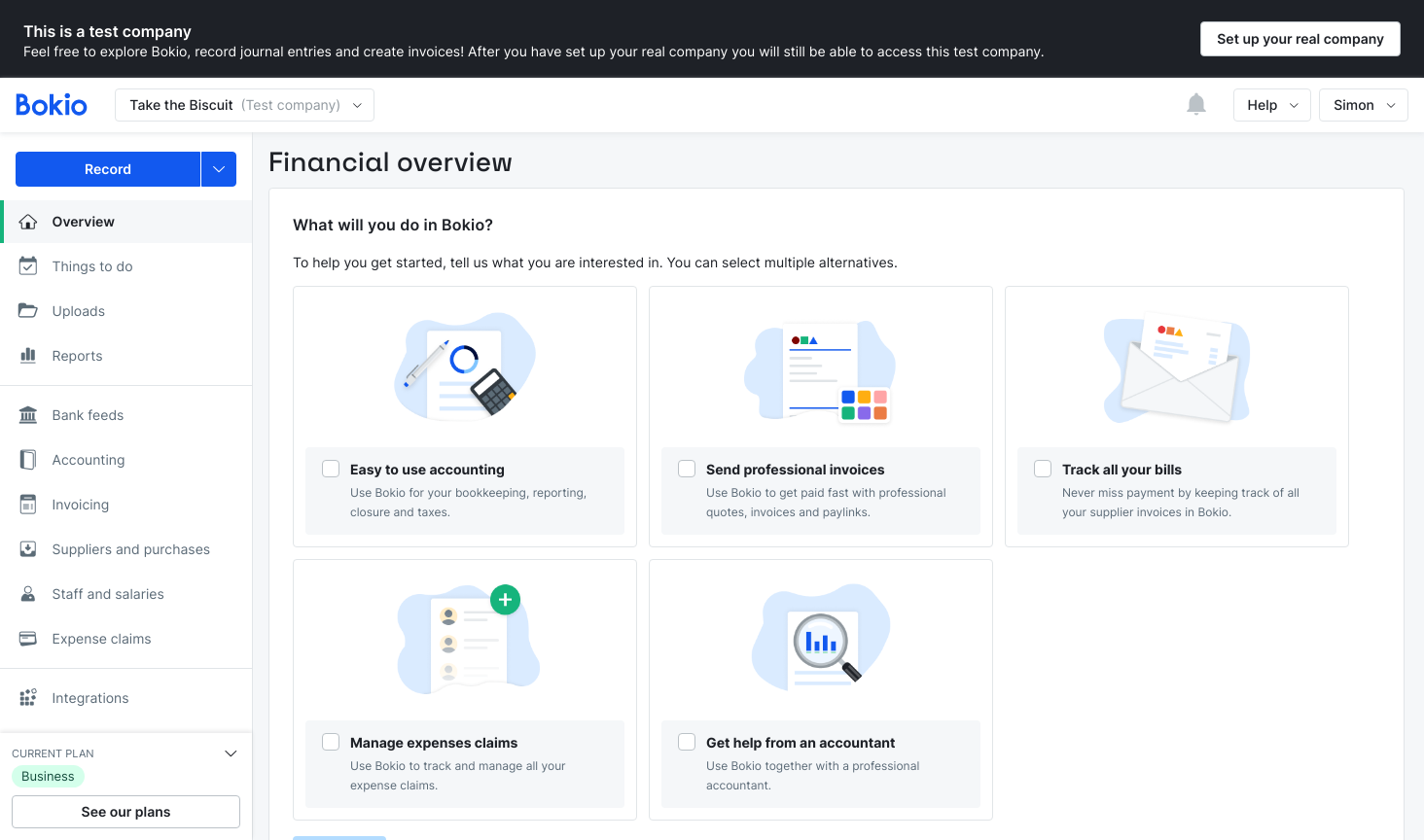

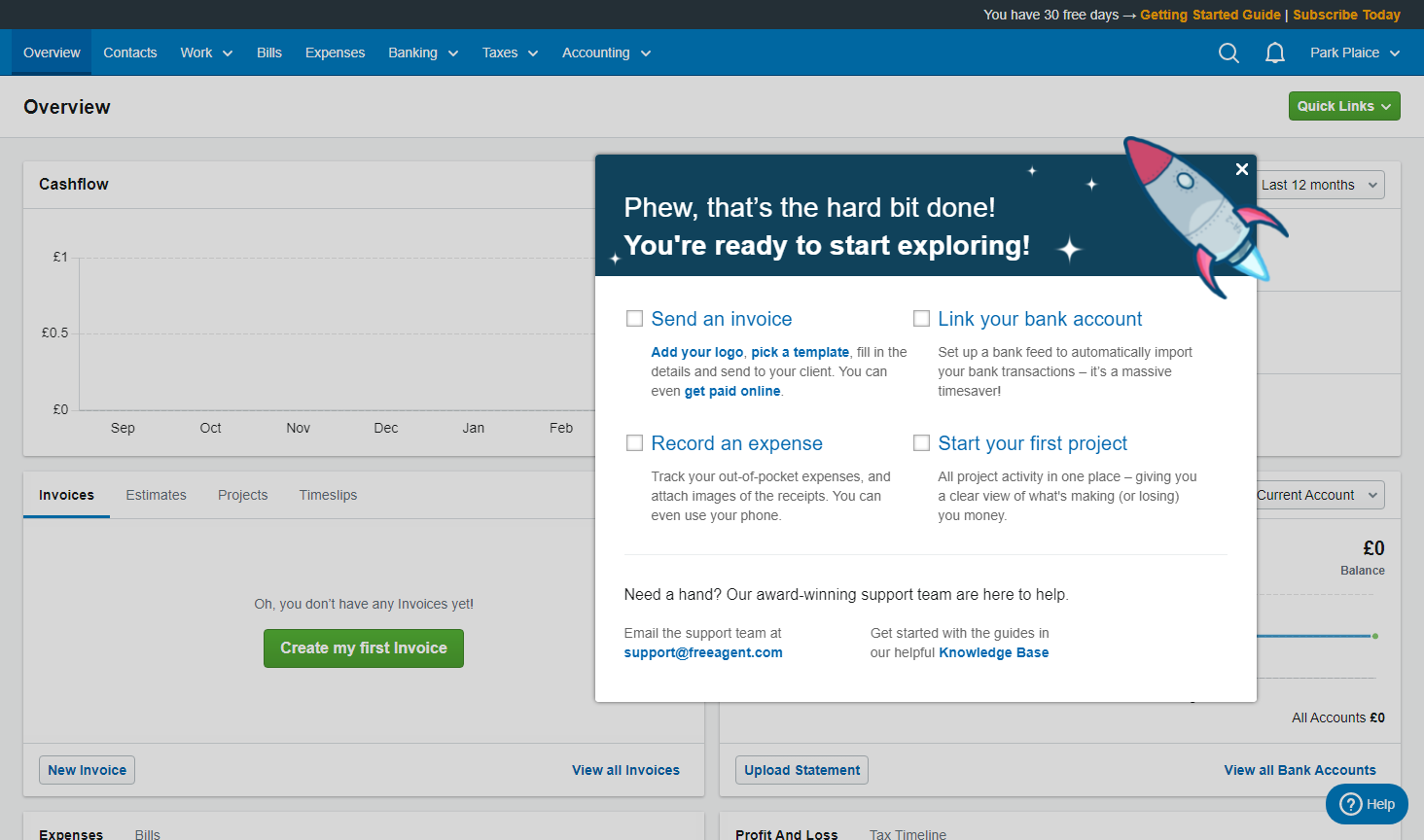

Crunch has the most attractive user interface that we have seen. Creating an account takes less than a minute, leading to a dashboard of options designed to help users create documents in Crunch for the first time. For brand-new businesses this probably isn’t such a bad thing, but anyone with data to import into Crunch (like a list of contacts or opening balances) will quickly notice the absence of any data-import tool or set-up wizard. Set up is much more laborious as a result, especially if you’re not too sure where the information belongs, or whether you even need to enter it.

The sidebar menu houses the self-explanatory ‘Sales’, ‘Expenses’ and ‘Banking’ options. Clicking into these opens up more detailed menus, some of which also have their own dashboard to provide an overview of that section.

All in all, finding your way round and getting to grips with Crunch is pretty simple.

Speed

The pages load fast, and we didn’t experience any lag, but this is largely because they do very little. We’ll come back to this when we talk about Crunch’s features.

The actual speed that users can complete their bookkeeping is hampered by several factors though. The first of these is the absence of any sort of ‘quick create’ option for documents, such as invoices or quotes, and users will need to work through each menu instead.

Crunch’s software also lacks many of the tools which you’ll find with other providers, such as bulk editing transactions, or bank rules to automatically reconcile banking transactions. It makes it much slower to use in comparison to other providers, despite its fast page load times.

Features

Crunch are unusual in that the free tier of their software includes bank feeds – most providers charge for this service. That said, the list of available feeds is limited; at the time of writing, they have feeds for 17 banks. It’s very restrictive, especially when compared with Pandle’s 10,000 + bank feeds. There is a way to manually upload bank statements for the current accounting period, but if you want to minimise manual data entry, or you bank with a provider which they do not support, then you’ll need to research other options.

Crunch’s bookkeeping platform is really a gateway to their online accountancy services, and this shows in the lack of any meaningful feature offering. The software is incredibly basic, and overlooks many of the features that businesses have come to expect as standard from other providers such as QuickBooks or Sage.

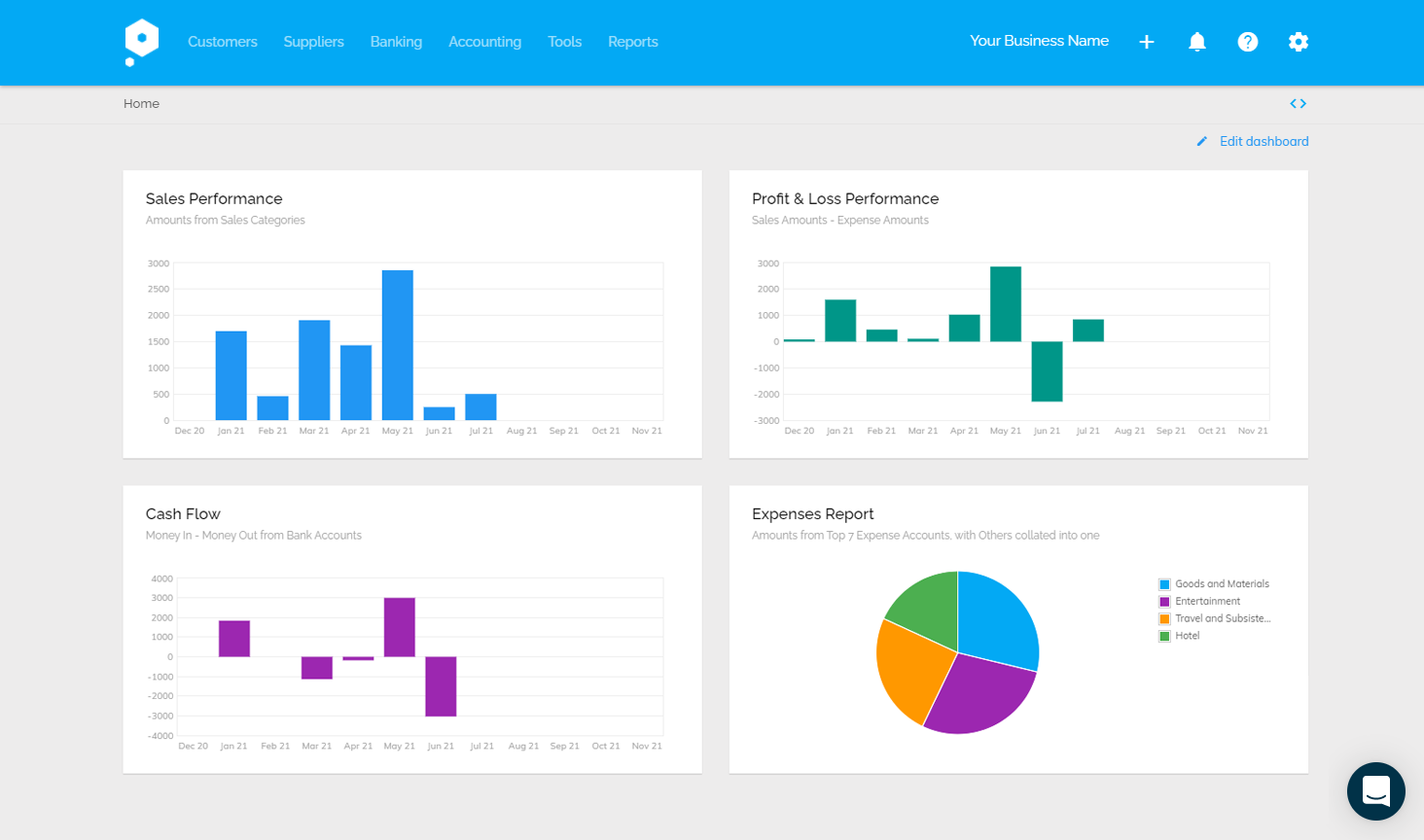

Stock control, projects, and cash flow forecasting, just to name a few, are all noticeably absent, but even the features that are on offer can be seen as ‘lite’ versions when compared with other competitors on the market.

For instance, their banking feature doesn’t include an option to create rules for automating transactions. You’ll need to click through each one manually, which is slow-going if you have more than a handful each month.

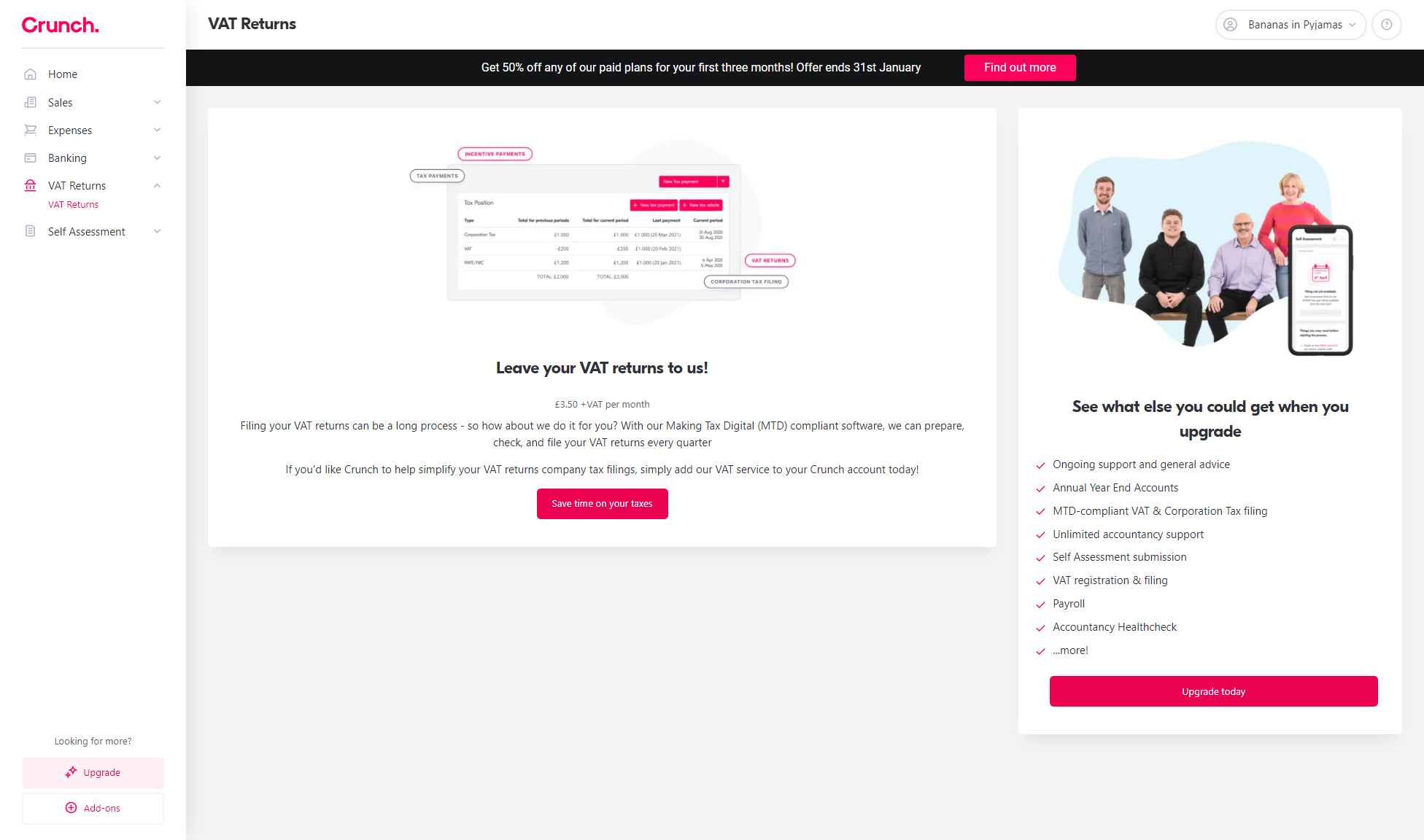

You won’t even be able to view any business reports using Crunch’s software unless you sign up to one of their accounting services, with prices starting from £27 per month for sole traders, or from £90 for limited companies. Every business will need reports at some point, so it does impact how useful the software alone can actually be.

Crunch also provide an option for MTD compliant VAT return submissions.

There is a separate app that you can download to capture receipts using your device’s camera. It’s designed to integrate with Crunch so users can store documents alongside transactions, although the current negative reviews suggest there’s much more work to be done here.

Support

They have a help centre that contains some basic guides to using the software, and their website has some really excellent articles about a range of business-related topics. You’ll need to sign up to one of their accounting packages (prices from £27 per month for sole traders, or starting from £90 per month for limited companies) to get help from a real person, even if you’re only after software support.

Price

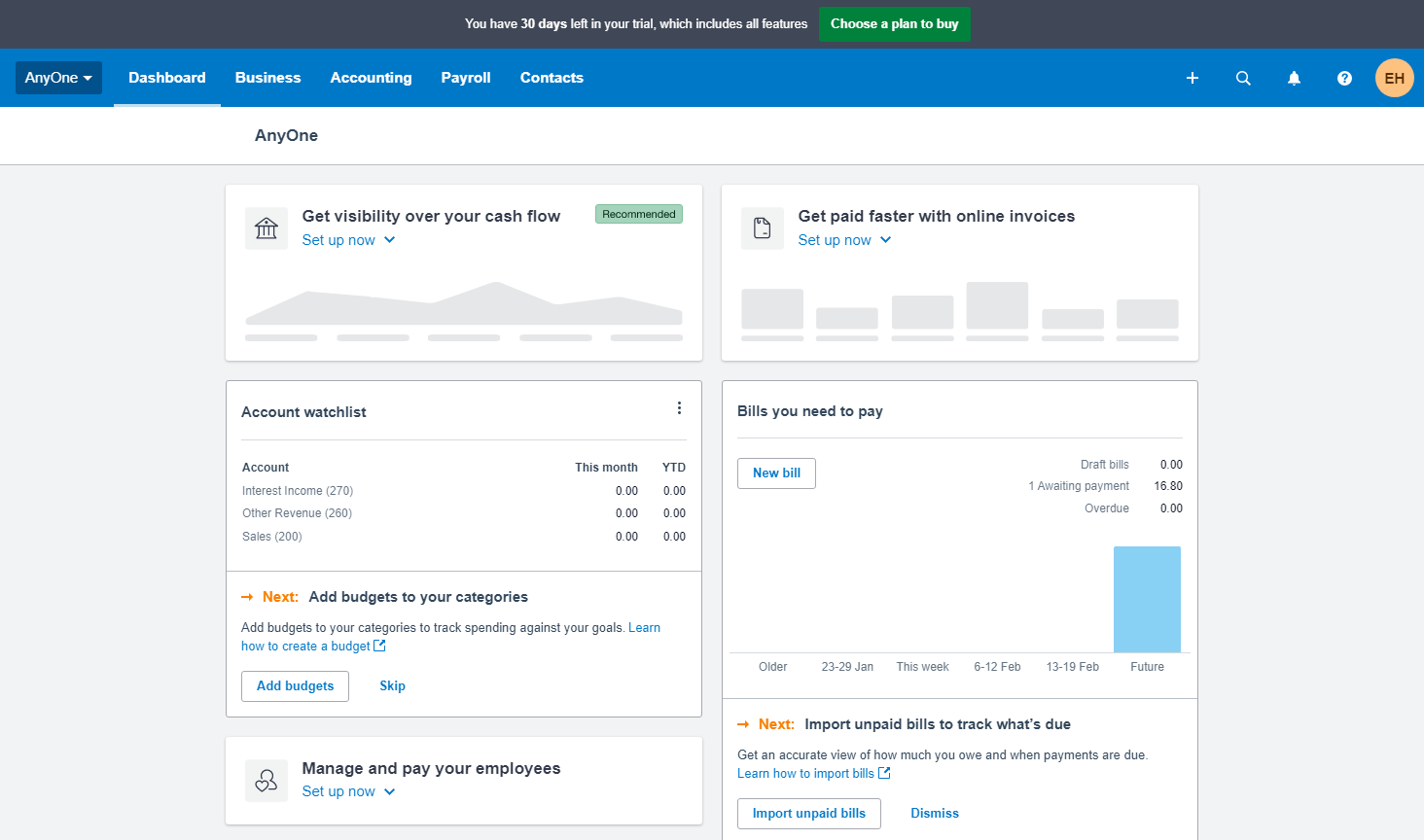

Comparing Crunch on price alone is quite difficult. The free tier is too basic to be useful for most business, especially compared to other free versions of accounting software that’s available.

With Crunch, once you start paying to access the full software, you’re not really in software territory anymore, instead moving into online accounting services. This makes it significantly more expensive than simply paying for software with a feature-rich provider. As an example, Crunch’s packages start at £27 per month for sole traders and £90 for limited companies, whereas FreeAgent (£19 per month for sole traders) and Pandle (£5 + VAT per month) are more accessibly priced, with far more features and tools.

Upgrading to Crunch’s accounting tiers does get you unlimited access to a team of account managers, or you can have direct access to your own accountant from £137 per month. However, some people might be put off by the fact that Crunch don't offer dedicated experts or assign an accountant to Sole Traders - only limited companies.

What level of bookkeeping knowledge will I need?

The software doesn’t do an awful lot and as a result it’s very stripped-back, so there aren’t many places to get lost. Clunky accounting jargon is kept to a minimum, and their help articles are decent.

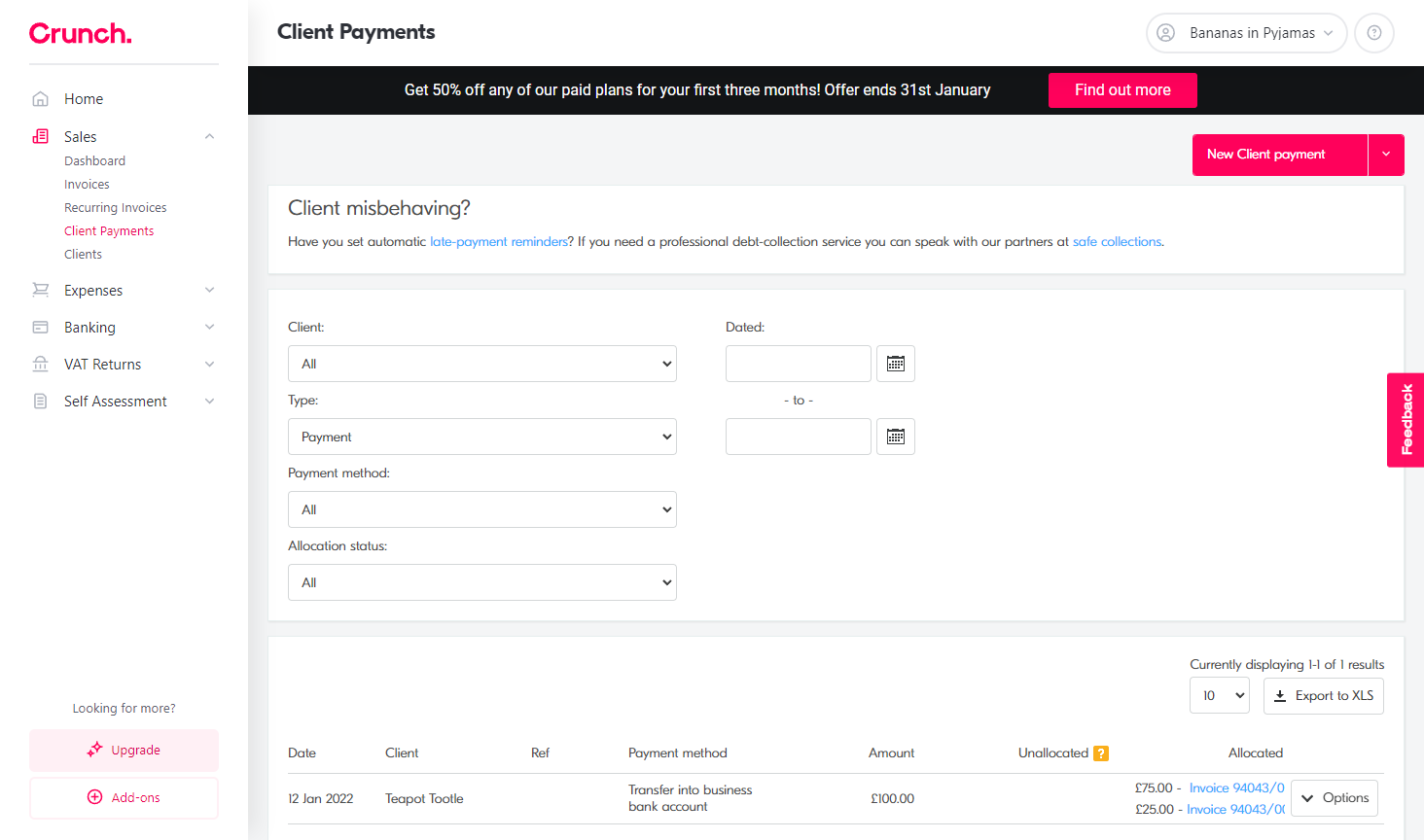

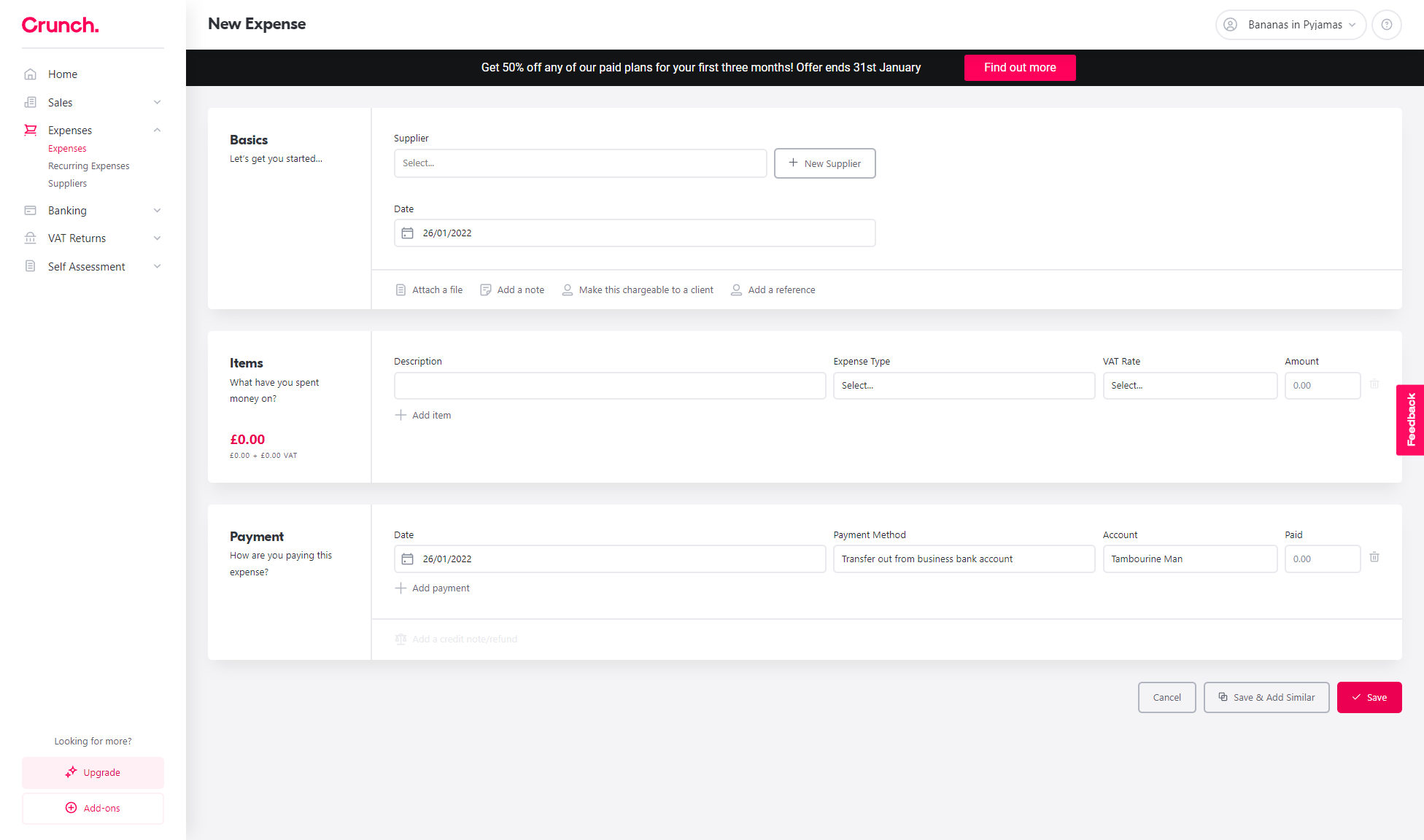

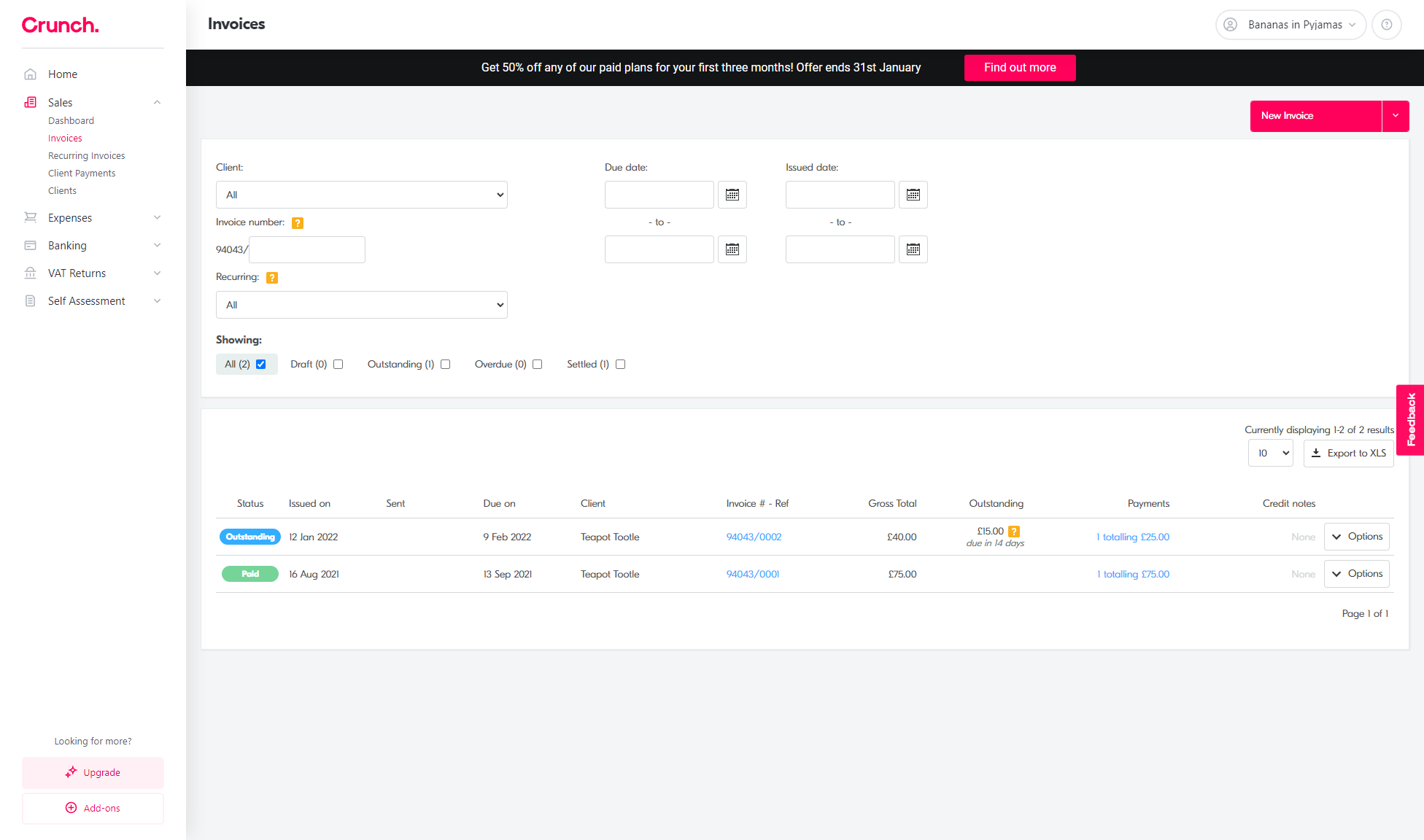

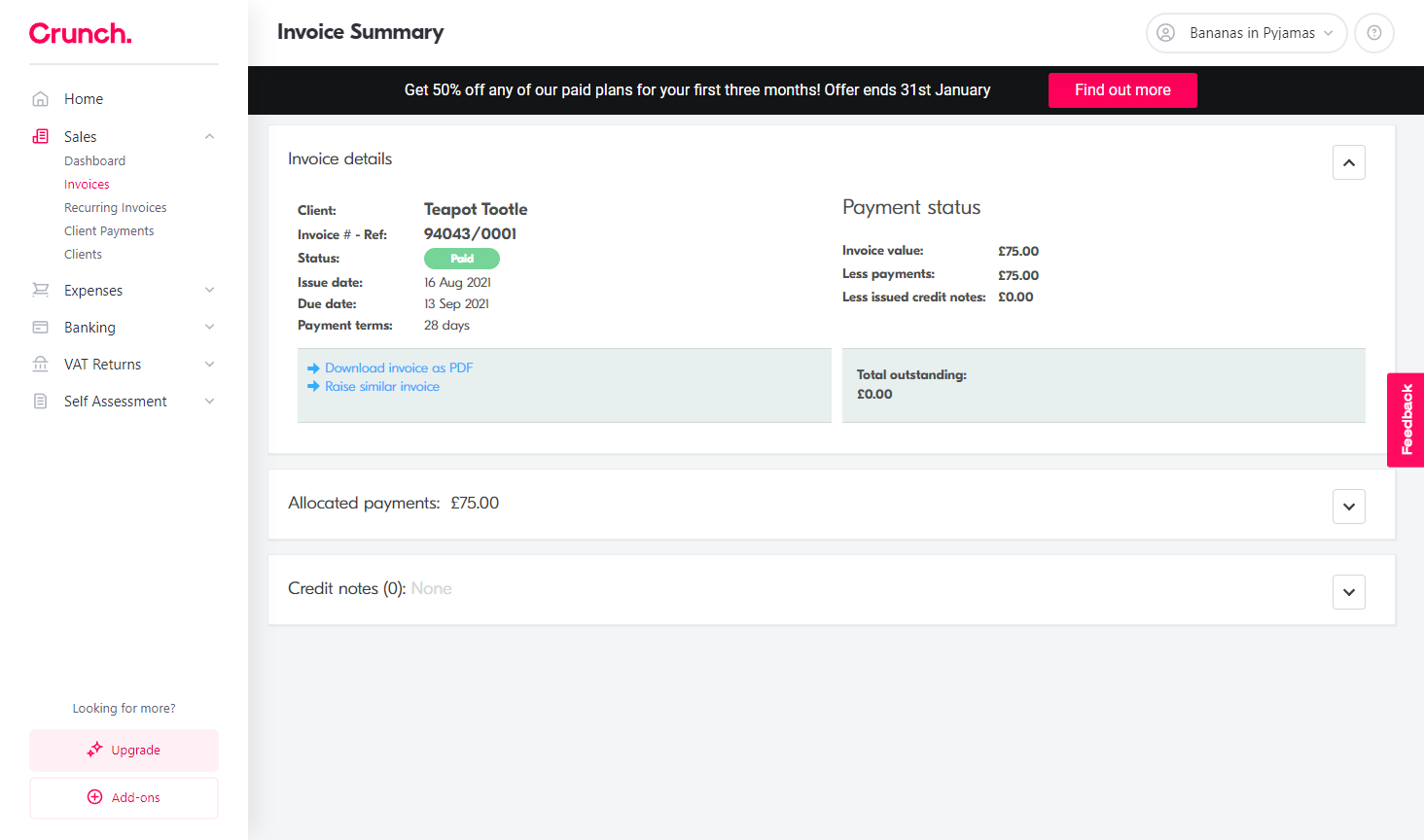

Software Screenshots

The software looks great, and their expenses feature has dropdown menus that do a great job of making it clear which expenses you’re allowed to offset against your income, and therefore claim tax relief on. 10 out 10 for visual appeal.

The lack of features is a massive downer, and renders Crunch’s software pretty much useless for most small businesses, unless you’re prepared to pay for their accounting services.

The user experience (UX as those in the biz call it) can be very disjointed. It would be useful to have some sort of quick create button to speed things up, such as creating documents or adding suppliers, without needing to go back to the dashboard or click through the menus.

Some of the on-screen banners recommending their partners can be quite distracting, too.

Echoing the same experience as ‘Cee W’ on the 12 Jan, we were also doxxed by Crunch accounting. They published personal addresses online, one has been online for over 6 months to our horror. We were met with complete neglect, frustration and confusion. We’ve mentioned this is illegal and they’ve turned nasty with lots of gaslighting. They’ve not resolved the situation and have attempted to double down on the gaslighting. Be deeply careful with Crunch they will doxx you put you at risk and behave like you’ve done something wrong to protect themselves. Disgusting. It’s horrendous, the doxxing abuse is… Read more »

Shocking quality of service

The quality of service has been drastically declining over the last year. I pay over £100 every month and it takes multiple emails to support to get help.

My financial year ended in November and my years end accounts have still not been completed.

Support doesn’t read the emails you send in and just answer some general text.

The bank reconcile seems to break every month too.

They raised their fee every year and the service is shockingly poor quality now

They only care about how much they can get out of you If you are after accountant that care about your account and setting you up for success, this isn’t it Crunch’s services are abysmal but if you just need the bare minimum it is somewhat decent Don’t expect your loyalty to be rewarded if you ever need extra support, but expect costs to increase yearly and their service to never improve (some issues raised 5 years ago still happening, they dont support some major business banks, the user experience is awful and you almost always need to involve support… Read more »

I am sure there are many out there who have an “okay” experience with crunch. I was tempted to join crunch, a few years back, i thought they looked progressive, everything looked new and fresh, slick website etc. At the time i had little to compare them too, as i was new to accountancy software. I chose a limited company structure for my business, and was hoping that it would be easy to use software. It is NOT! The software is basic and clunky. In fact it downright awful to use! Support from crunch, is adequate id say but lacking… Read more »

I am appalled at the fact I have been trying to leave these guys after an unimpressive one year. I still have to continue paying fees for another year in order for them to complete my accounts. I have already paid for the years accounting i require. But now I’m paying for almost 2 years and they still haven’t completed my accounts. I’m just getting question after question drip fed over a long period of time about minor issues. All issues should be raised in one email not spread out over months so that i keep paying. This is starting… Read more »