Our review of Clear Books

Clear Books does take some getting used to, with some quite confusing terminology and a menu which gives the impression of having grown somewhat organically as features were added, and is now in need of a rethink. Even professional bookkeepers might find the software a bit clunky to use as a result.

Small businesses with a very moderate number of transactions could find it suits them, though they might need some basic knowledge to get started. There’s no live chat support, but user reviews suggest they're pleased with the customer service on offer.

Their pricing isn't awful, with the cheapest package available from £13 per month (£6.75 for the first 3 months), but this largely offers the same features which are available for cheaper elsewhere, and with a less confusing layout to deal with!

Review breakdown

-

Ease of use

-

Speed

-

Features

-

Support

-

Price

-

User Experience

Summary

Overall Score

User Review

( votes)Software Features

Ease of Use

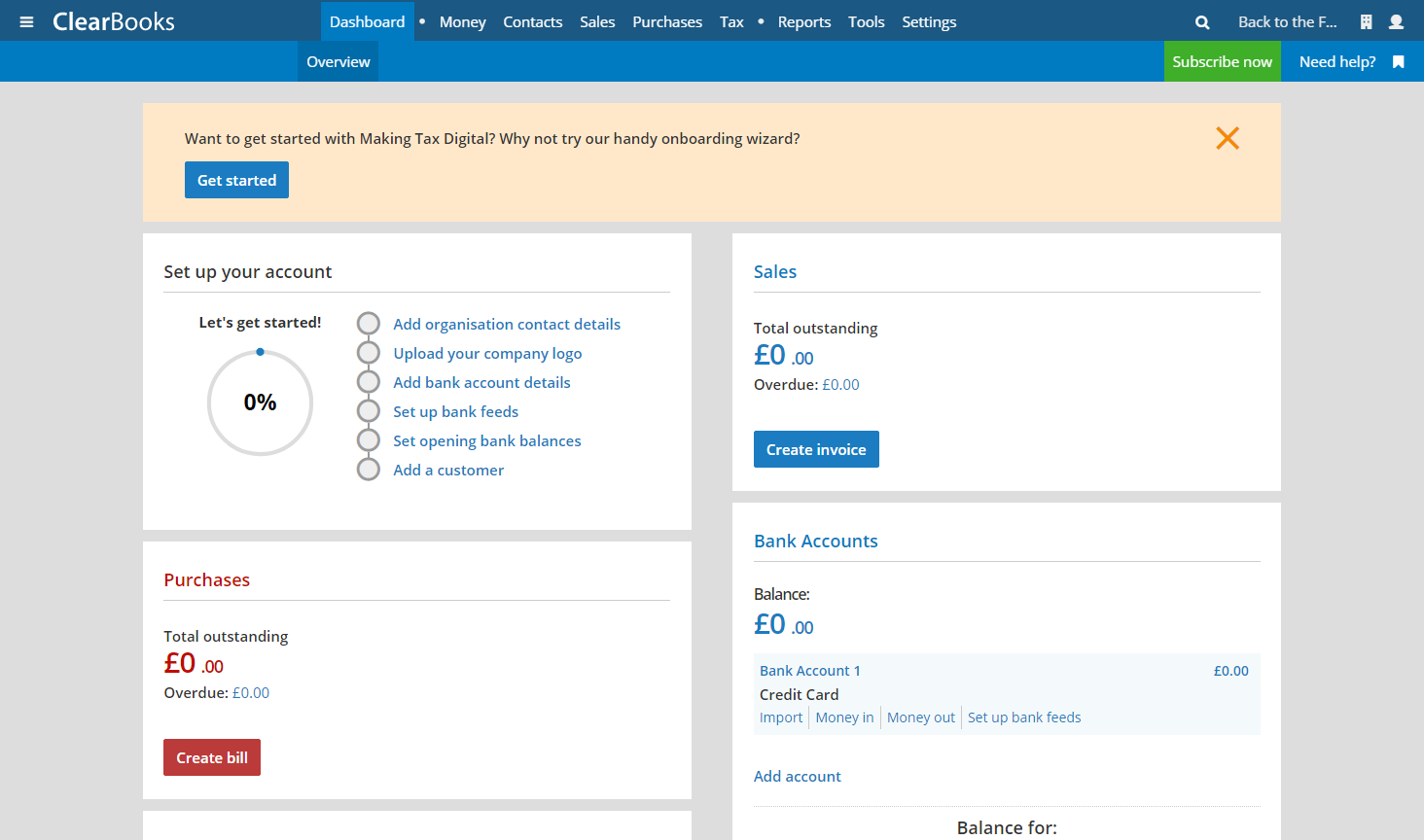

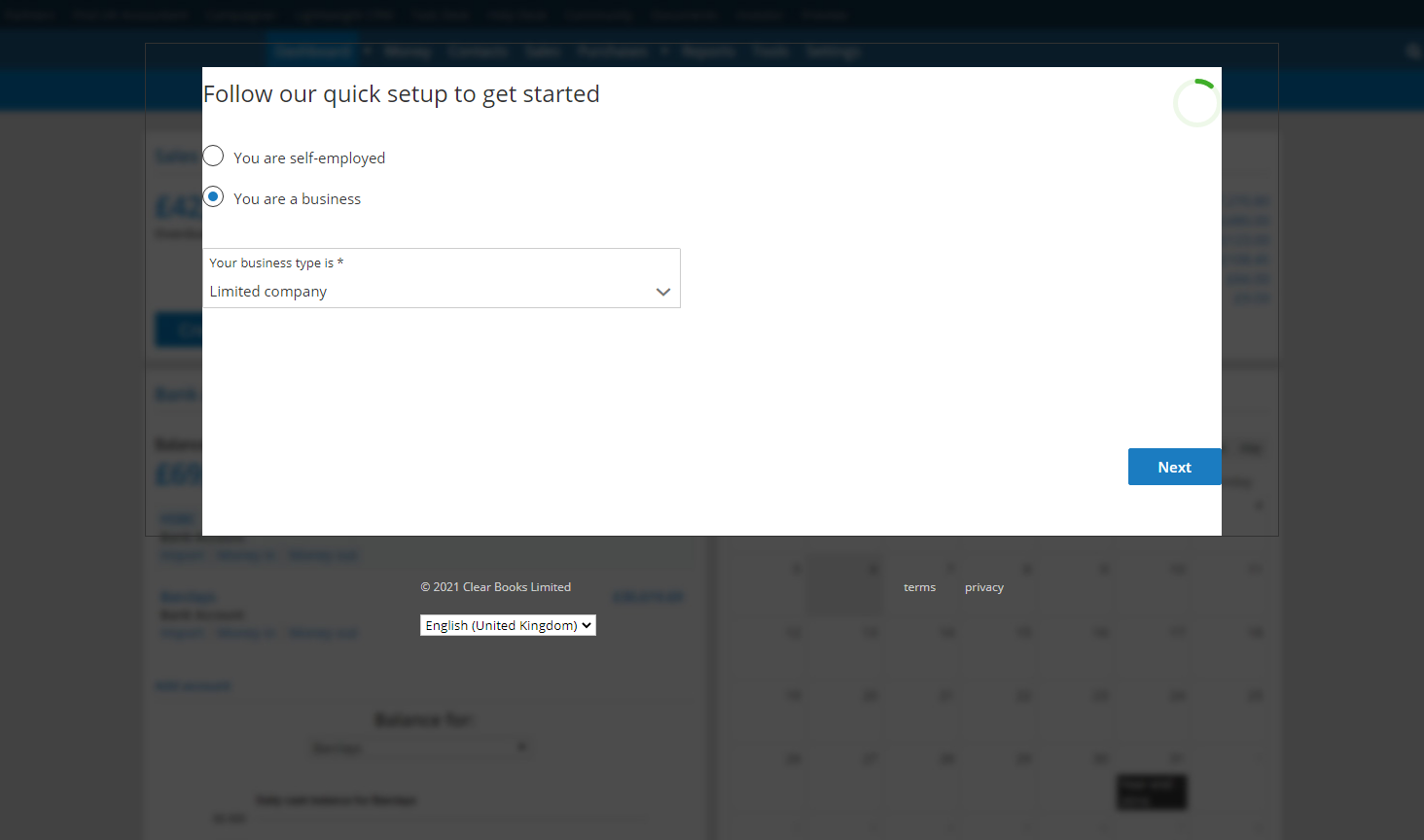

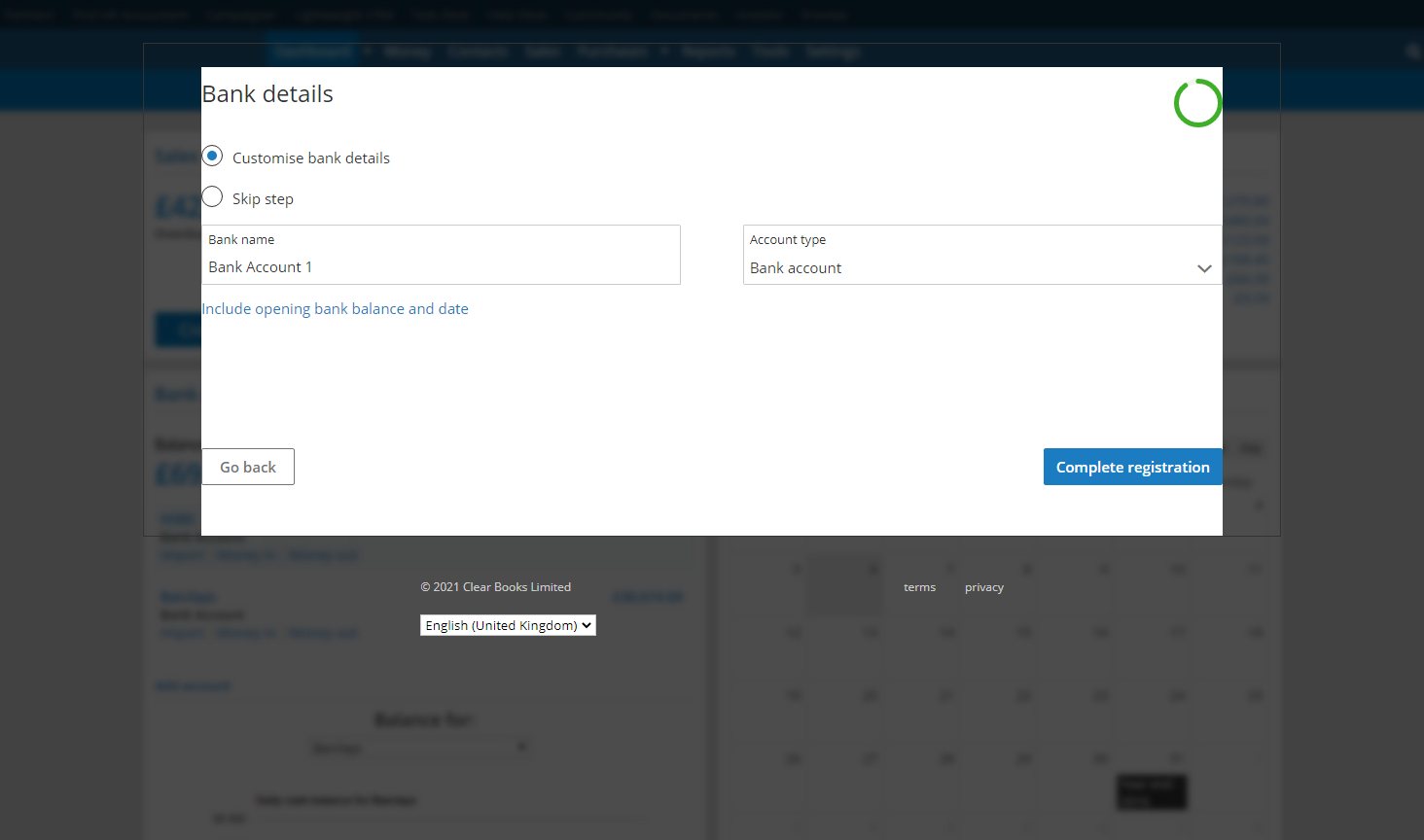

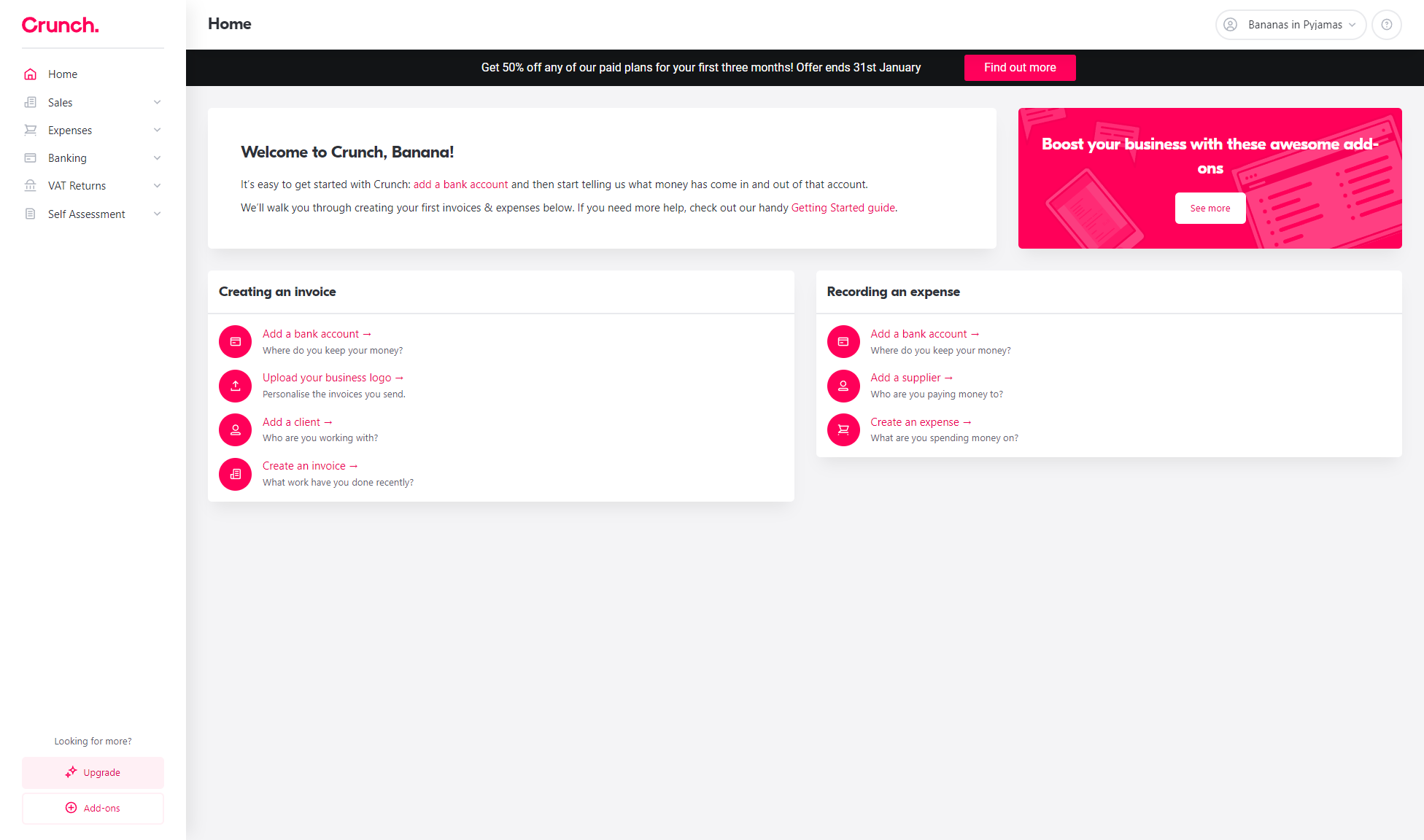

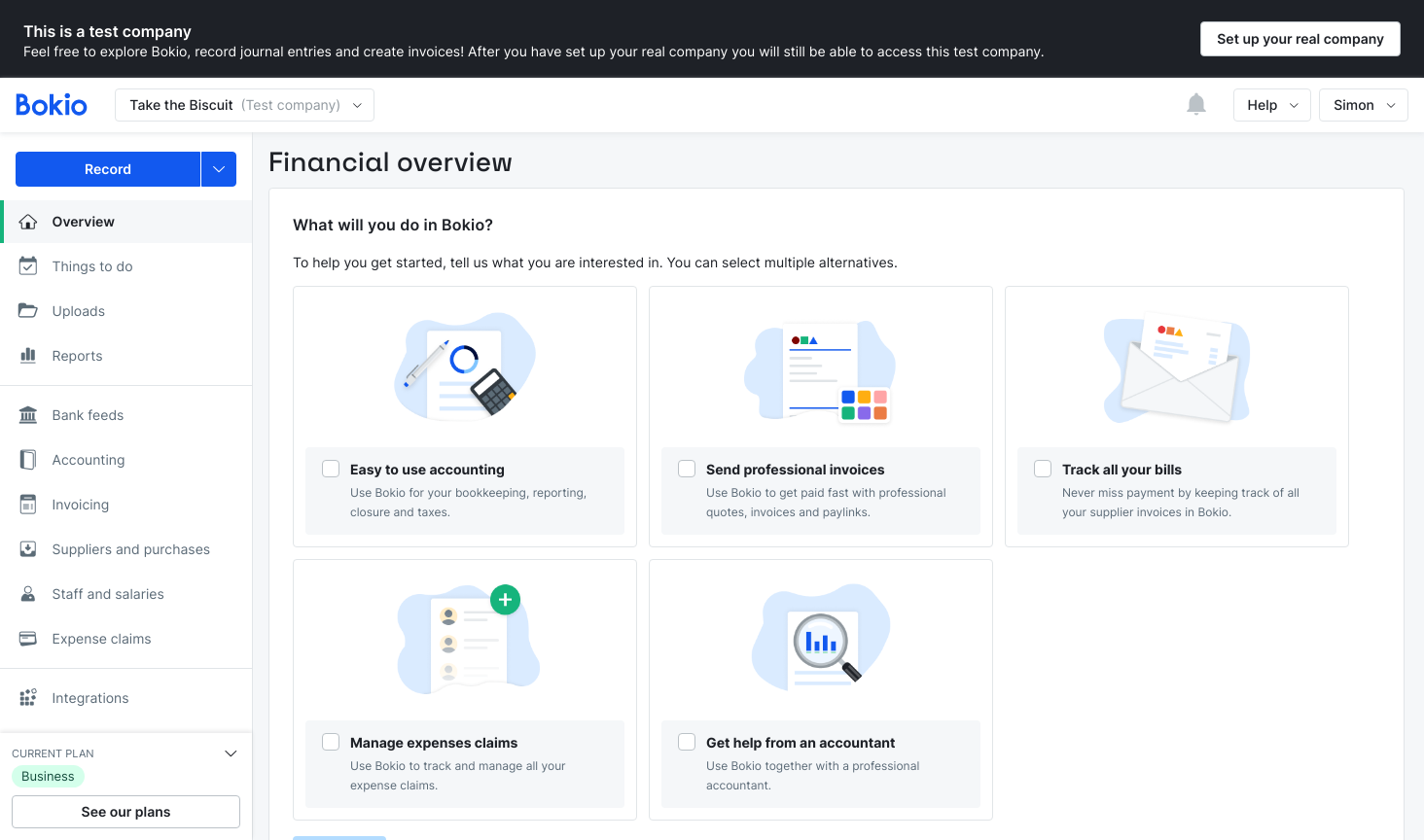

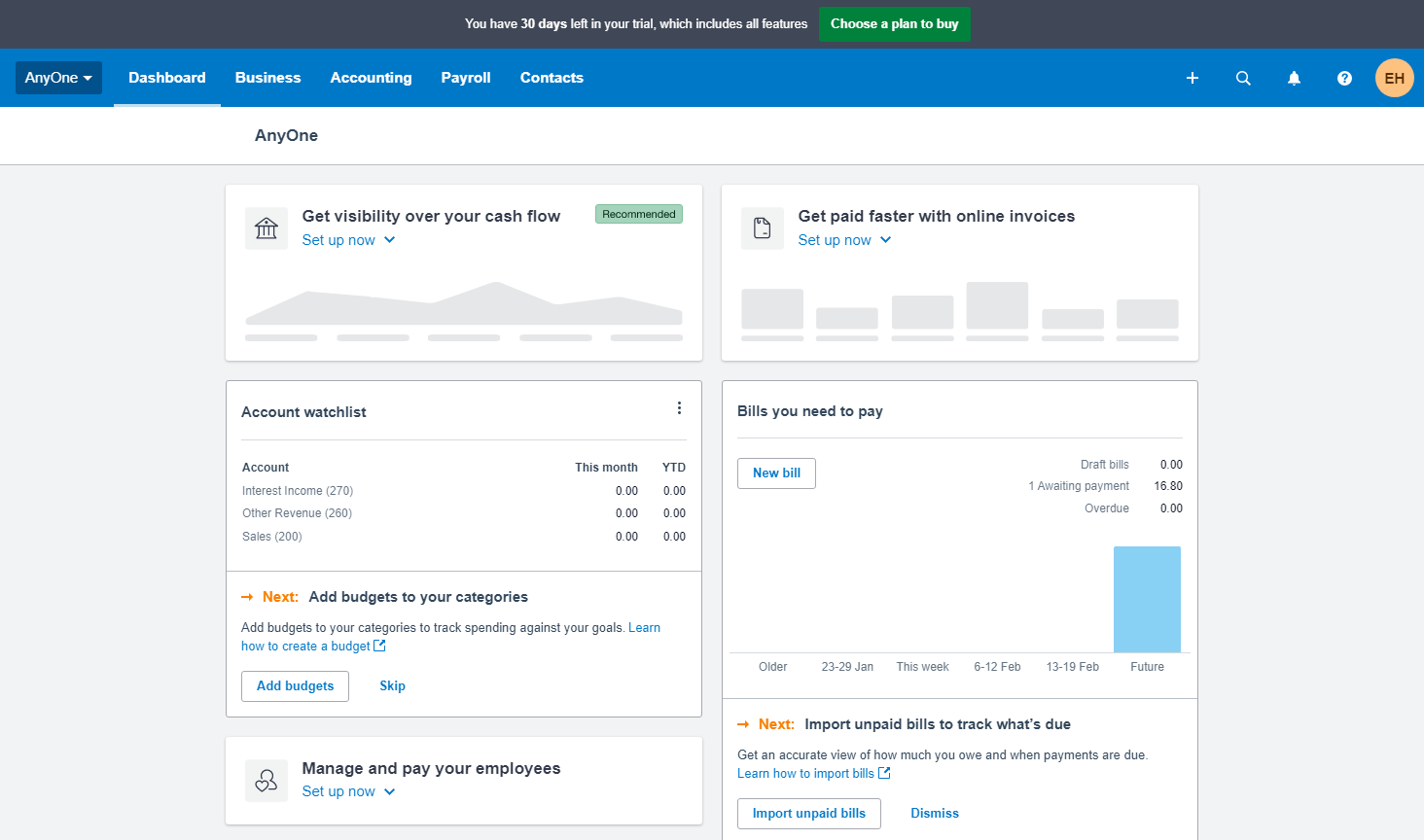

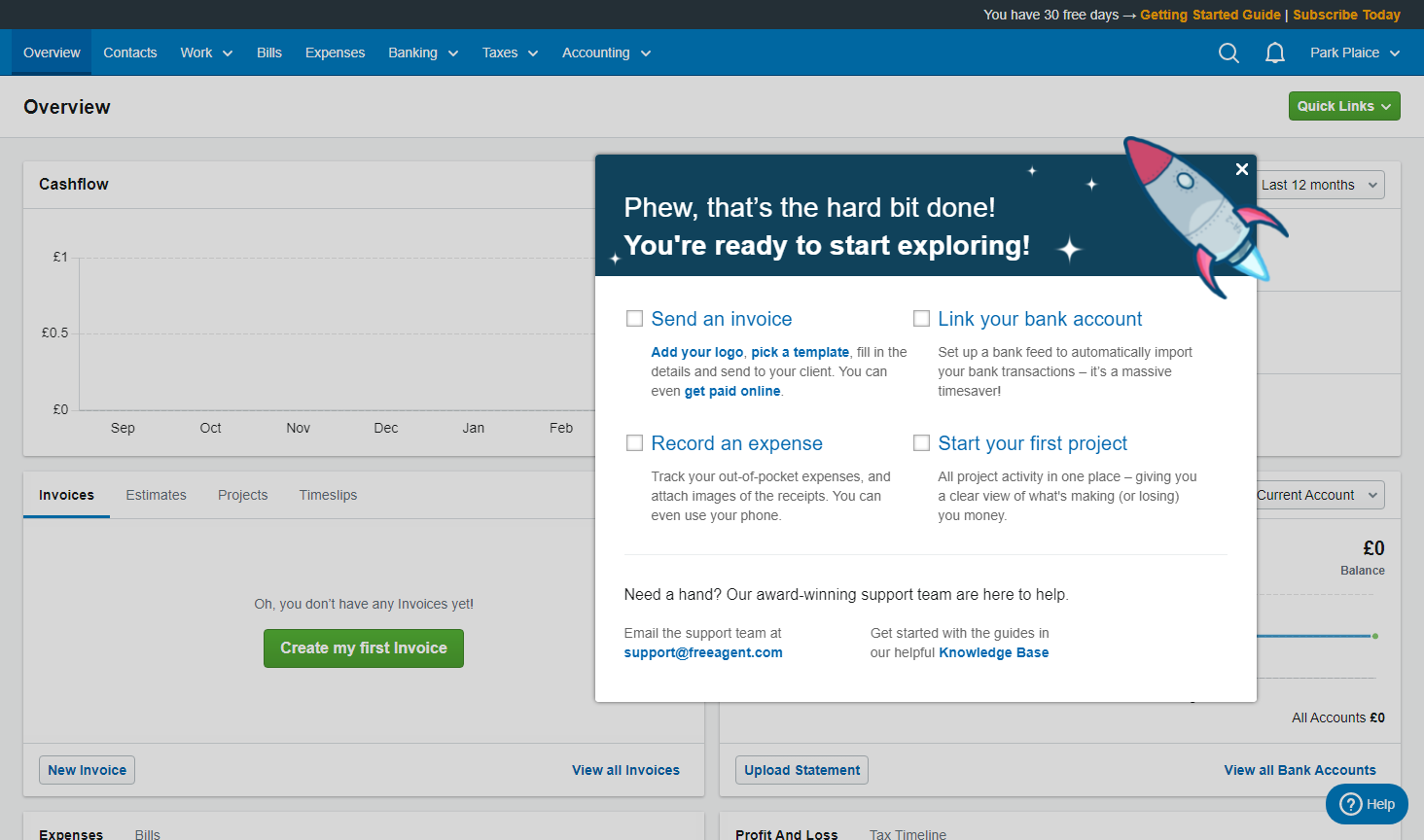

Starting out with Clear Books is simple enough, with a free 30-day trial which you don’t need to enter card details for. They have a go at guiding the onboarding process, with a progress indicator on the dashboard showing the stages you should work through to complete your account set up.

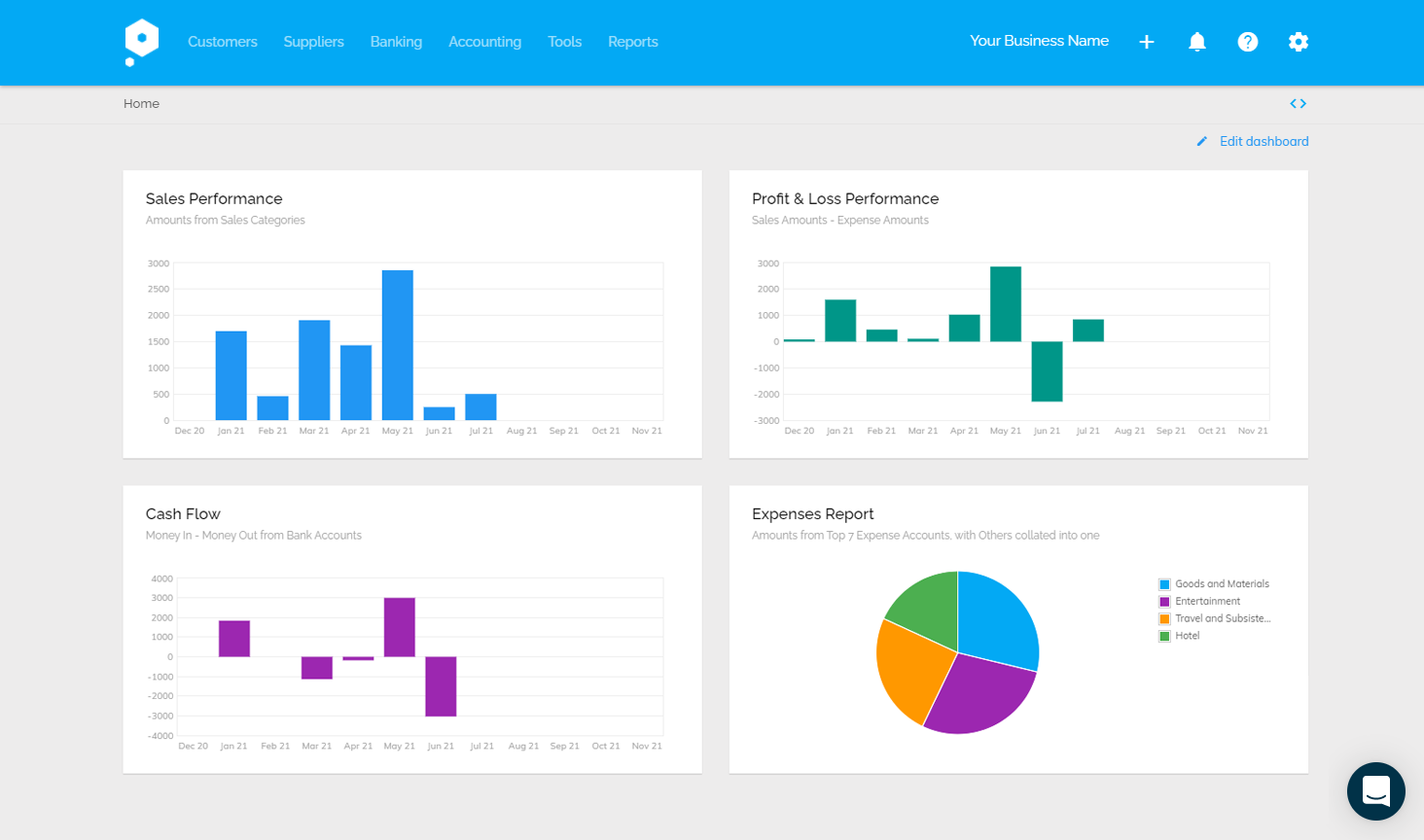

The dashboard is generally pretty informative too, though we couldn’t help but feel there’s an awful lot going on with the navigation menus. It’s quite busy, and some of the menu names don’t entirely make sense. For instance, ‘money’ actually relates to bank accounts and statements, but then sales, purchases, and tax are all listed separately elsewhere.

Totally new users might find some of the terminology confusing, whilst more experienced bookkeepers might find the navigation at odds with some of the industry standard terms.

Speed

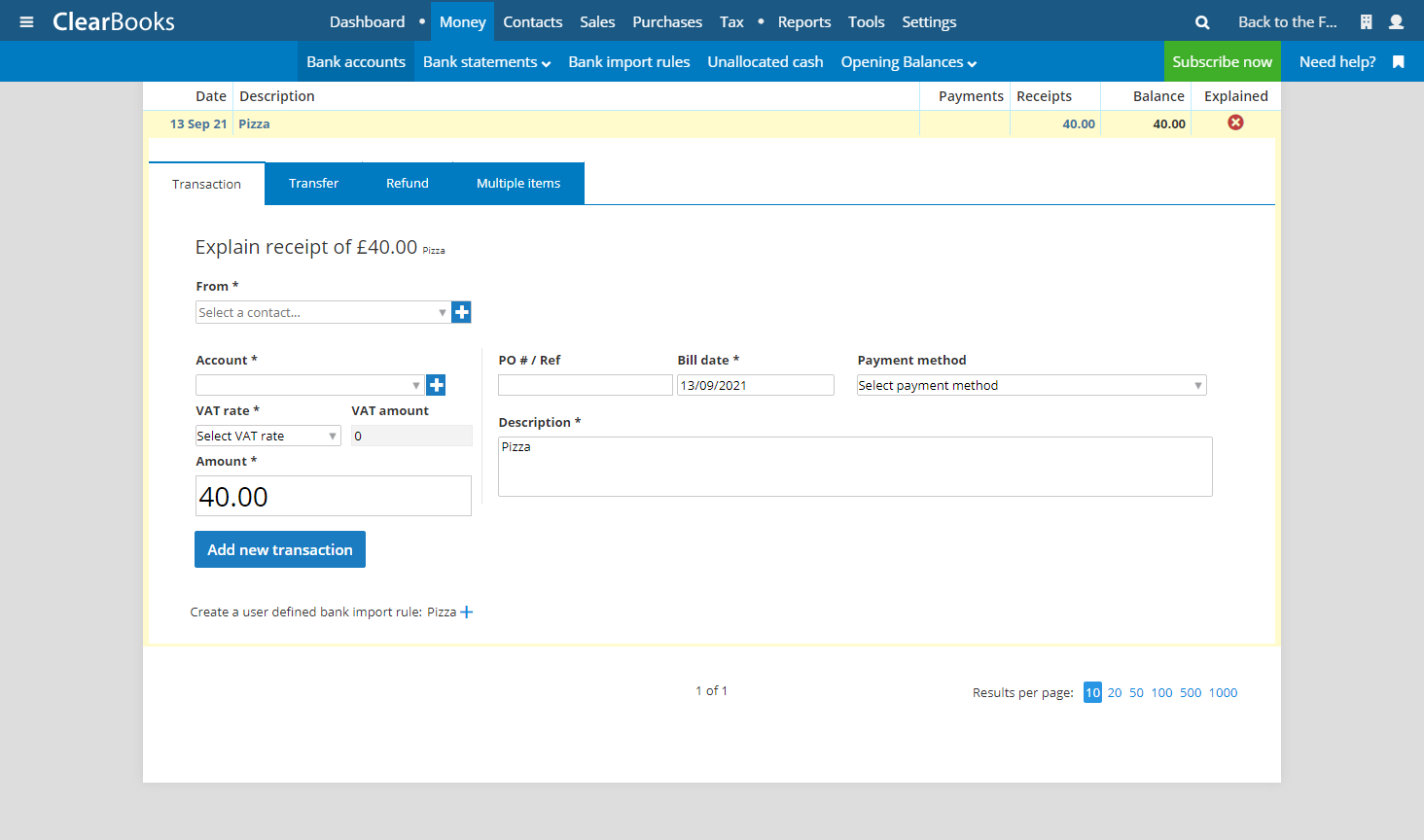

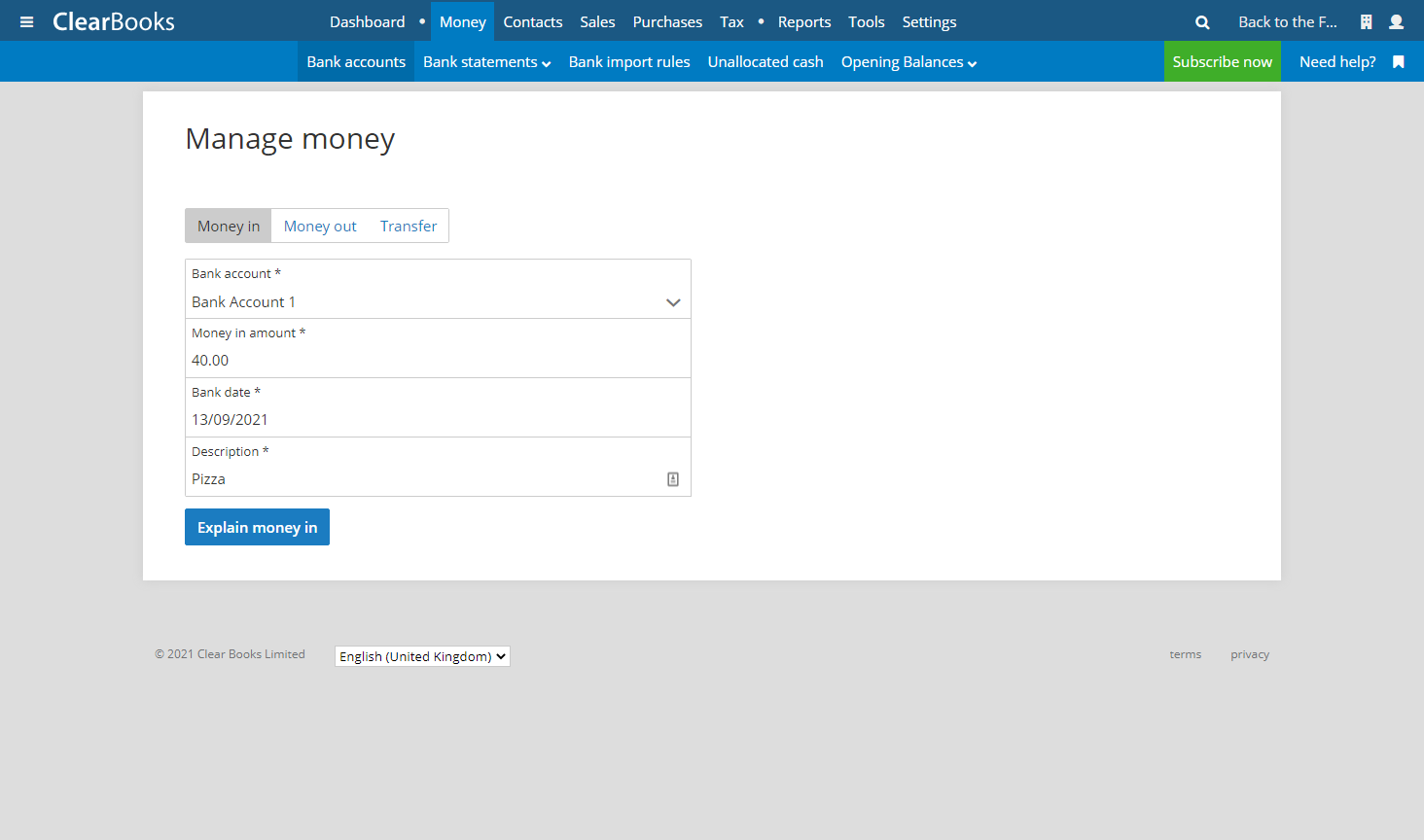

Whilst the software itself is fast, the speed of using Clear Books is let down by how long some processes take. Entering transactions can be quite arduous, with multiple steps required. For instance, processing a payment for fuel turned into a three-step process.

- Step one: enter the date and amount etc.

- Step two: explain the transaction, i.e., assign it to a supplier (even if it was an instant payment).

- Step three: choose a payment method and check the VAT and invoice then add the transaction.

Some transactions just don’t demand this level of information, such as entering customer and supplier details for a fuel payment. Businesses processing a lot of transactions are likely to find the process to be rather time-consuming.

Fortunately, Clear Books do offer live bank feeds as well as an option to import bank statements, which can improve the burden of data entry though you’ll still need to spend time explaining each transaction.

In general, this is a common issue across Clear Books, with each process just taking too long. It would be nice to see import tools for customers and suppliers too. Anyone transferring from a different software provider will need to flex some data entry muscles first.

Features

Clear Books does have a wide variety of features such as multi-currency handling, automatic bank feeds/imports, recurring invoices, direct debit integration, project handling, PO handling, payroll, and HR. There is a PayPal feed but it only works with a business account.

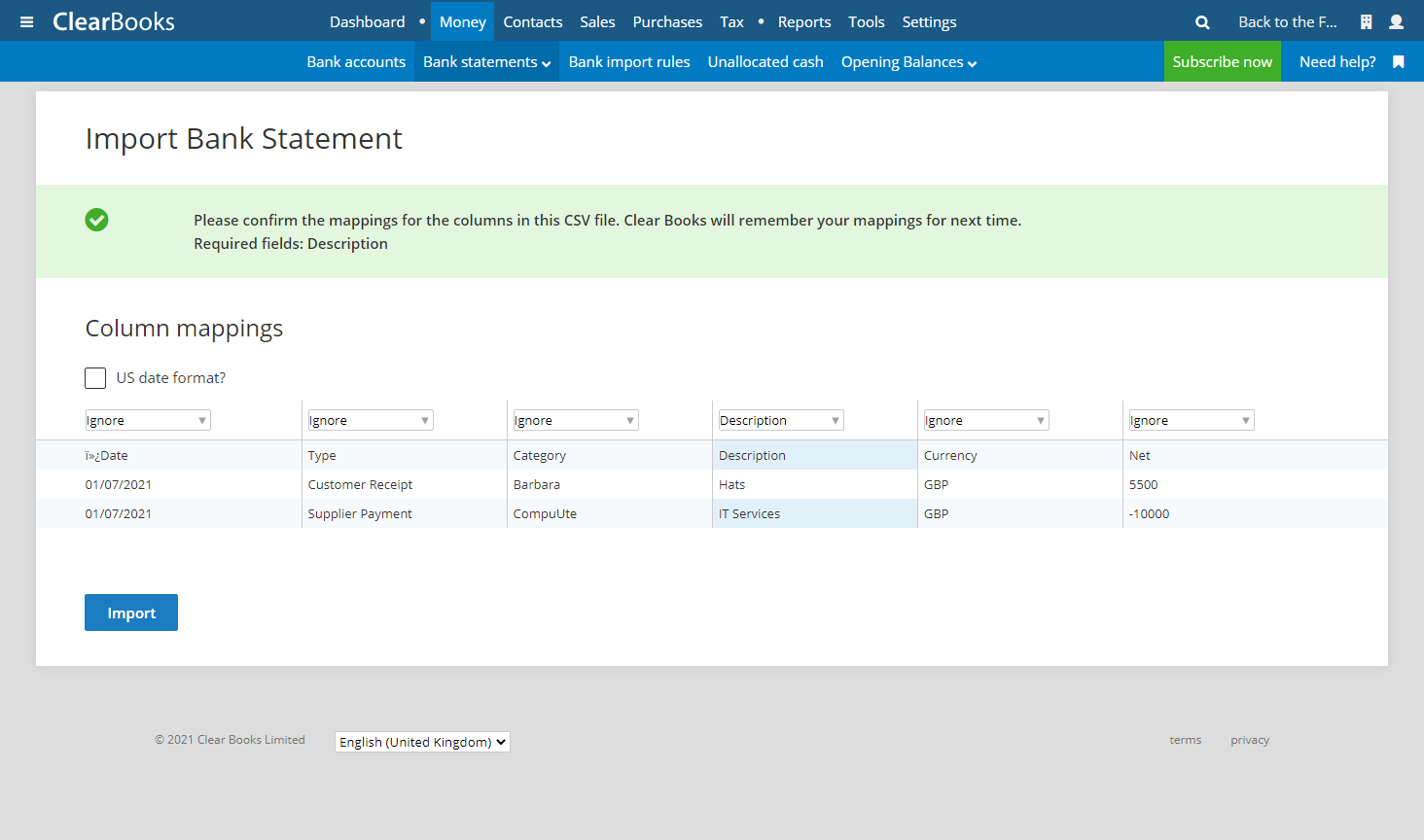

Importing bank statements is pretty easy, and you’ll be asked to map your headings to those in Clear Books. The dropdown menus for choosing your headings are rather limited, which is particularly annoying if you want to record the currency or customer/supplier.

This becomes especially frustrating when you must then go through the process of ‘explaining’ each transaction. This isn’t a very intuitive process, and took us quite a few minutes to work out what needed to happen. A nice big save button would be helpful, too.

Their reporting tools are varied, with 28 to choose from. The trial balance was good, with the ability to drill down into accounts to see how the balance was made up. However, the profit and loss report, and the balance sheet, were poorly laid out and didn’t provide the ability to drill down either making them very useless for detailed reporting.

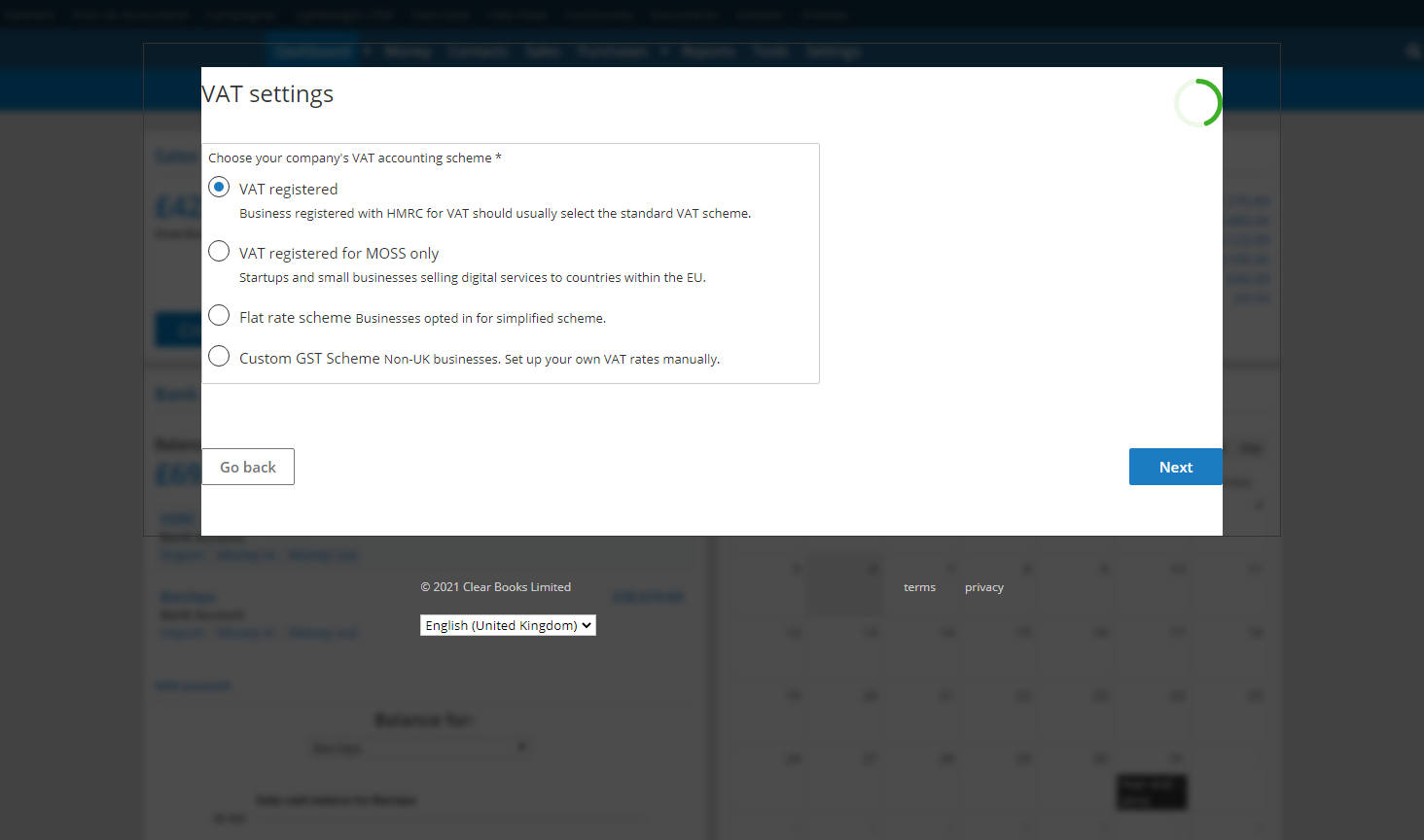

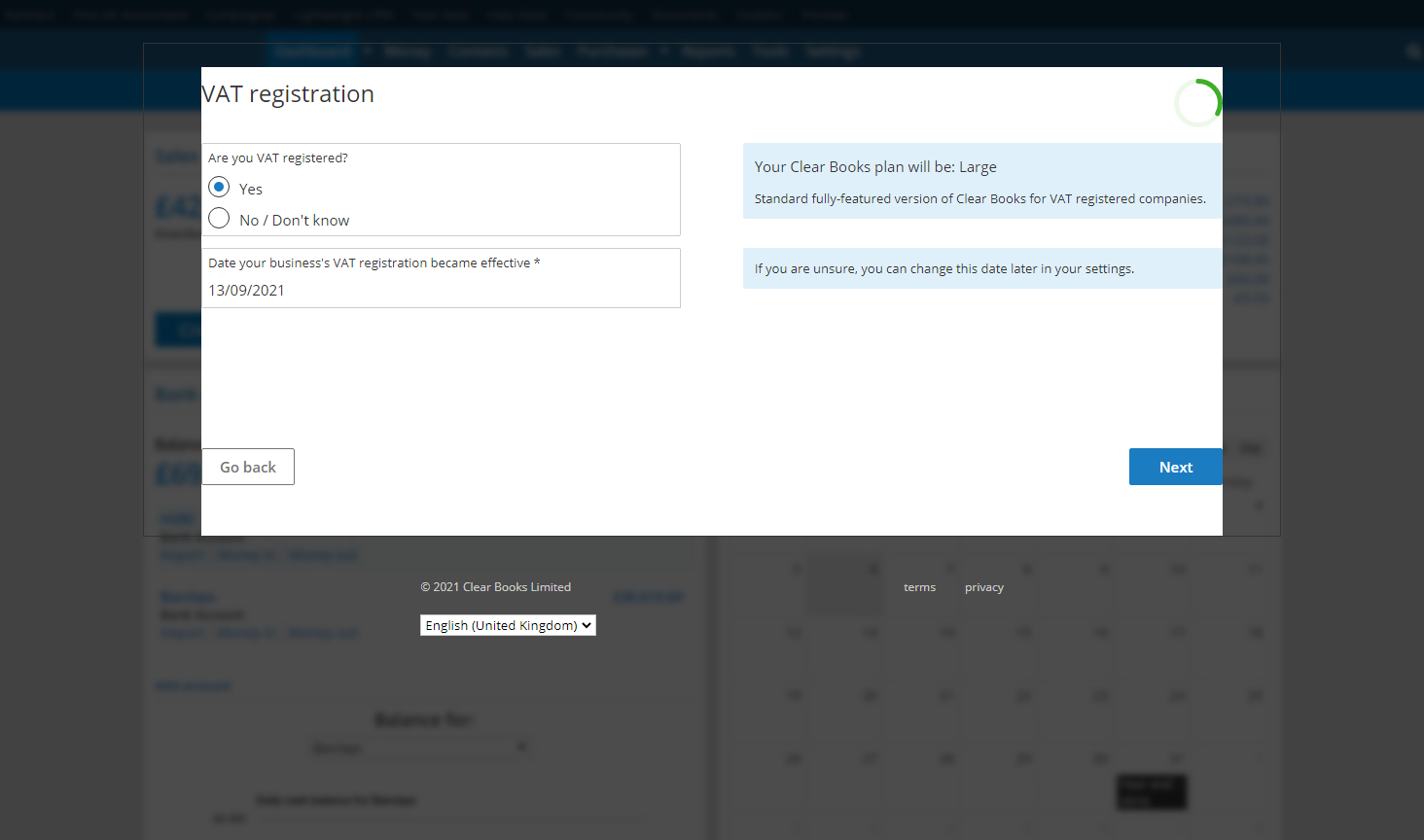

Clear Books handles VAT very well. It seems to have been developed for the UK which means that it can take care of cash accounting and the flat rate scheme, and can also handle a switch between accruals to cash accounting and vice versa. The VAT reporting is also very good, a breakdown is given for all of the figures that make up the VAT return.

The multi-user controls are very detailed, and you can fine-tune what other users can see or edit.

Support

Clear Books have a big support portal with guides explaining how to use particular features. Their customer service reviews are pretty stellar, though it seems the lack of live chat could become an issue. Support is included in the monthly subscription, along with access to a community network.

Price

It is possible to get a low-cost version if you have very basic requirements, but most users will need the ‘Medium’ package if they want more automated tools. This starts from £29 per month (£14.50 for the first 3 months). There are additional features available, such as projects and multi-currency management, on the 'Large' package available from £36 per month. The software is quite pricey for what it does, and aligns itself to some of the larger providers.

What level of bookkeeping knowledge will I need?

You don’t need to be a professional to use this software, but we do think a novice would have a hard time understanding everything. Some bookkeeping experience would definitely be required.

Software Screenshots

We really liked how well VAT was handled, and the user permissions control was nice.

We did not like the complexity and the time it takes to process basic transactions and the huge amount of menu items to figure out!

Video

so far trial period use it looking good